Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINTata Consultancy Services Ltd. (NSE:TCS) is an Indian information technology services, consulting and business solution organization. The company ranks amongst the top 10 global IT services providers in the world. TCS offers a consulting-led, integrated portfolio of IT, BPS, infrastructure, engineering and assurance services to its global clients. The company employs over 370,000 people in 45 countries and is a part of India’s largest industrial conglomerate, the Tata group.

Currently the company accounts for just 1.7% of the global market share, indicating sufficient room for future growth. TCS delivered decent FY17 results and generated strong cash flows despite headwinds from currency movement. It also declared its first share buyback since its listing which also was incidentally India’s biggest buyback recently. Though the company has failed to grow through acquisitions, it has delivered well organically. Let us look at the investing prospects of Tata Consultancy Services Ltd.

TCS Positives

a) Extensive portfolio of Software & Services and Customers

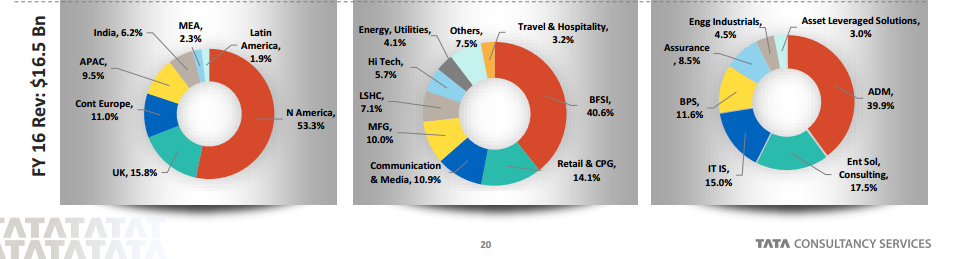

TCS serves a wide range of industries like banking & financial, energy, government, insurance, manufacturing, telecom, utilities etc. The company provides a host of services and software to its global clients such as consulting, business operations, product engineering, AI, Big data, Cloud computing etc. This makes the company flexible and diverse not only across geographies but also across business lines.

Broad Diversification

Source: TCS Presentation

The company continuously invests in building new capabilities and innovative solutions to stay relevant in the constantly changing technological environment. Over the years, there has been a steady and strong progression of customers into higher revenue buckets. In the last year itself, the company added 35 clients in $100 million+ band, 11 clients in $50 million+ and more.

b) FY 2017 Performance

Full year revenue growth was 8.6% in Indian currency. Geographically, Europe, India, Latin America, Middle East and Africa all grew in double digits while other geographies grew between 6%-7%.

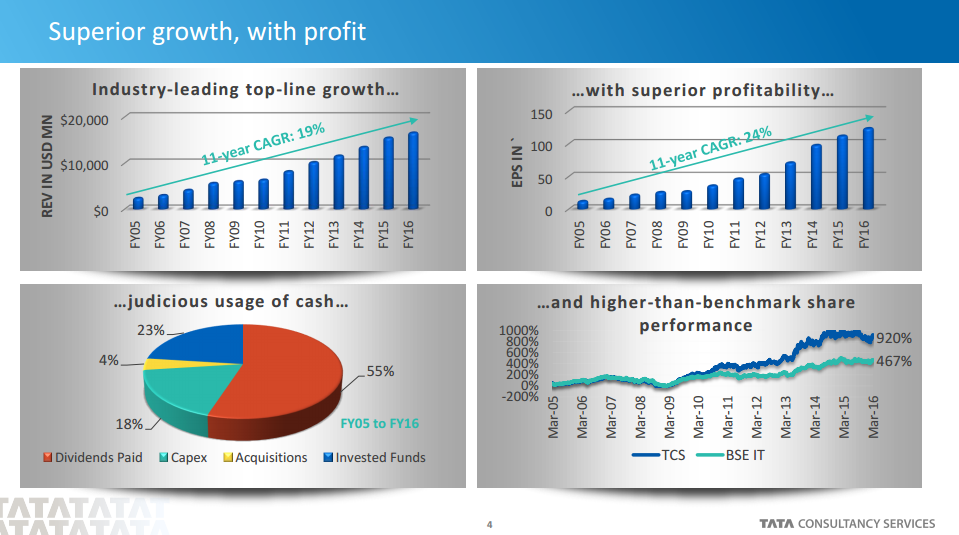

TCS’s digital services also witnessed strong adoption across industry verticals with over 55% of the company’s clients engaging through digital services. Digital revenues (including business process services, IT solutions and infrastructure services) accounted for 16.7% of FY 2017 revenue up 30% y/y. Though a bit late to the party, Agile, Automation and Cloud are the other technologies where the company is now focusing strongly. The company’s new products and platforms are significantly gaining traction amongst clients. “ignio” world’s first neural automation system for IT operations in enterprises, won 17 new clients in FY’17. TCS has also shown good performance in the past as well as is evident from the image below.

Source: TCS Presentation

c) Improving Prospects of the IT industry

2016 was marked by political and business uncertainties and continued volatility in BFSI and Retail segments. However, an improving U.S. economy and possible BFSI turnaround are positive catalysts for the Indian IT industry going forward. The Indian IT industry has now entered into a phase where it has matured and slowed down to high single digit – low double digit range. The IT industry is expected to maintain moderate global market share gains even as currency volatility will continue to plague the sector’s growth.

Tata Consultancy Services signed 9 large deals in the last year which were well distributed across verticals, with 3 in BFSI, 2 each in Life Sciences and Utilities and 1 each in CPG and TTH.

d) Returning Cash back to Shareholders through Share Buybacks and Dividends

Between 2010 and 2016, TCS has returned 43% of its profits to shareholders in the form of a dividend. With its recent buyback announcement, the total payout will increase to 54%.

The company announced INR 16,000-crorebuyback of 5.61 crore shares (representing 2.8% of the outstanding shares) at a price of INR 2,850 per share, at a premium of more than 10% on its current price. TCS generates a large amount of surplus cash and with no alternative investment opportunities at hand, returning cash to shareholders is a good way to send positive signals to the market. Coming to dividends, the company rewards investors through three interim dividends, one final dividend annually and a special dividend every couple of years.

TCS Negatives

The Indian IT companies have faced major headwinds in the form of economic and regulatory uncertainty, pricing pressure, volatility in IT spending. With the Indian rupee strengthening and negative cross currency impact, these companies have struggled in 2016.

TCS faces immense competition from the likes of cloud-computing providers like Amazon Web Services. Though TCS has been evolving its traditional outsourcing model, it still has a long way to go in automation and other advanced technologies.

Though the company has grown organically, TCS has failed to acquire any new company in the last year unlike its peer Wipro Ltd (NSE:WIPRO) which is strengthening its product offering through acquisitions. Even after the share buyback program the company will be left with a cash pile of INR 23,000 crore. It is time the company puts this cash into use.

Valuation

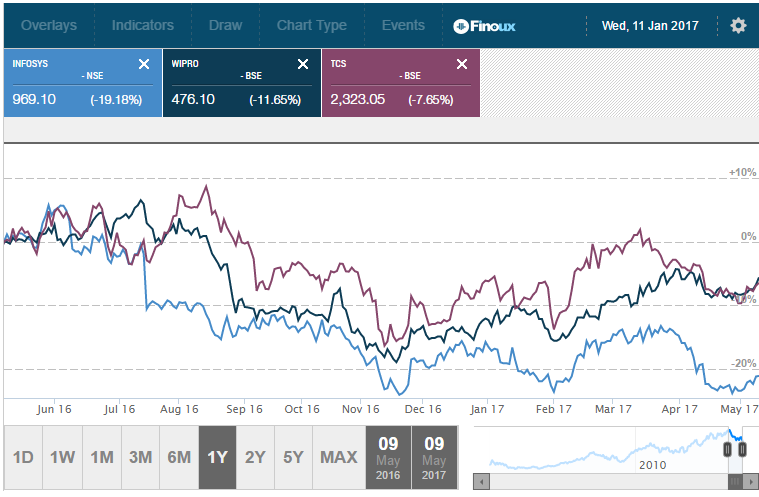

The stock is currently trading near INR 2,330 and has lost 7.3% in the last year. TCS has a market capitalization of INR 459,602 crores and a P/E of 17x which is cheap when compared to the industry average P/E of 18.7x. The stock returns have been better than peers as seen from the graph below.

Source: Moneycontrol

Conclusion

Tata Consulting Services should benefit from rising spend in clients’ digital transformation and an increased investment in new technologies. Even as the Indian IT industry shows signs of maturing, TCS is in a good place given its increased focus on AI and automation, and vast geographic footprint. In India too, TCS has won projects with MNREGA, India Post and several state value-added tax systems and should benefit from the Digital India movement. TCS has successfully delivered revenue growth, high shareholder returns and dividends over the past years. With most of TCS’s rivals seeing a drop in profitability, TCS new CEO Gopinathan has managed to make the company most profitable outsourcing company globally. I think that the Trump’s H1B issue blowback, new technology changes and currency impacts are temporary and TCS with its fundamental strengths should overcome these headwinds to emerge stronger in the future.

share your thoughts

Only registered users can comment. Please register to the website.