Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINPower Grid Corporation of India Ltd. (NSE:POWERGRID) is state-owned transmission utility in India. Incorporated in 1989, today Power Grid is a 'Navratna' Company operating under Ministry of Power. The company engages in power transmission through inter-state, inter-regional and transnational links, and is also responsible for planning, implementation, operation and maintenance of Inter-State Transmission System. It owns most of the high voltage transmissions assets in the country. Power Grid is also managing the renewable generation integration and operation in the country.

Given its strong government backing and millions of Indians still without electricity access, Power Grid is a buy in my books.

Power Grid Positives

i) Extensive Asset base throughout India – Power Grid transmits nearly 45% of the total power generated in India through its extensive network of 142,989 ckms (circuit kilometres) of transmission lines and 226 sub-stations (as on 30th September 2017). The company also has 13 joint ventures and 11 subsidiaries. The company uses state-of-the-art technologies like HVDC, SVC, FACTS etc. and its maintenance techniques at par with global standards. The huge transmission network consistently has an availability of more than 99%.

ii) Government Backing – Power Grid has a strong government backing with 57.9% of its equity being held by the Indian Government. The company also maintains excellent credit rating with financial institutions. Power Grid enjoys the reputation of a world-leading integrated transmission company with leadership in emerging power markets.

iii) Electricity Market in India is growing – India is a growing nation with increasing population and demand for power. India has deployed $11 billion rural electrification program, called Deen Dayal Upadhyaya Gram Jyoti Yojana, which targets delivering power to 18,452 villages by 2018. PowerGrid is playing an instrumental role in the successful implementation of the Deen Dayal Upadhyaya Gram Jyoti Yojana and Integrated Power Development Scheme on behalf of the Indian government.

Being the Central Transmission utility of the country, Power Grid will benefit from the trends of a more flexible transmission system, faster adoption of renewable energy and smart cities, digitization etc. The company is also aggressively expanding its transmission capacity which should drive future revenues.

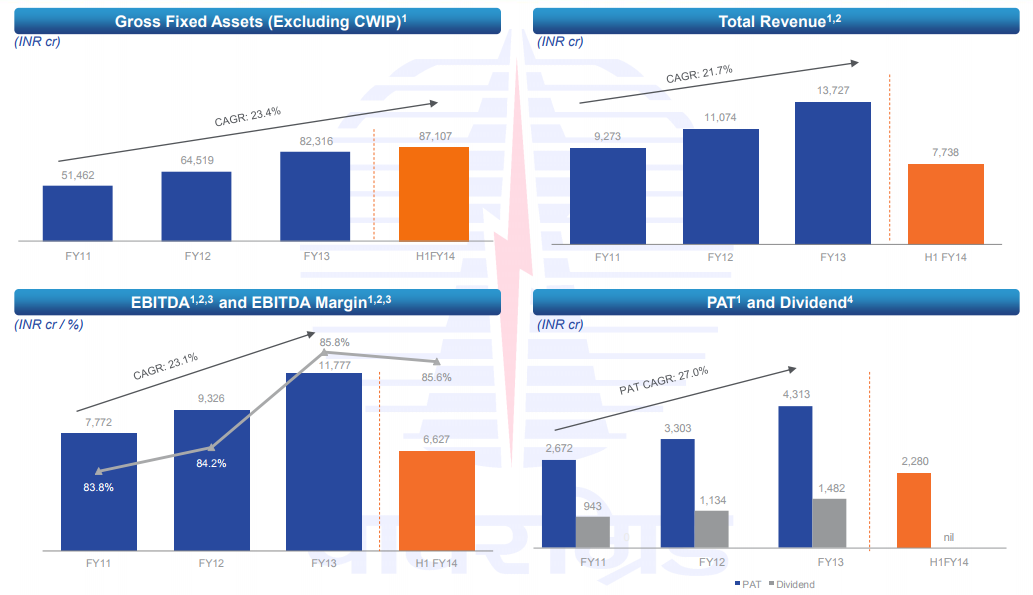

iv) Strong Financials - During FY 2016-17, Power Grid has achieved a turnover of more than INR 26,500 crore and net profit of over INR 7,500 crore. The company has been reporting good results each quarter. The company has registered a growth of 20% CAGR in income over the last five years. Power Grid has also been paying dividends consistently since 1993 and has grown shareholder wealth by four times since its IPO. A strong financial track record, conservative capital structure and increasing operational efficiency are Power Grid’s USPs.

Source: Power Grid Investor Presentation

v) Other Businesses – Apart from power transmission, Power Grid also engages in other businesses like domestic consultancy where Power Grid provides transmission related consultancy to more than 150 domestic clients. It also has a telecom business with Power Grid operating a ~43,450 km of telecom network. The company has attractive and visible growth prospects in consulting and telecom business. These businesses will also leverage from Power Grid's nationwide transmission infrastructure and brand reputation.

Biggest Challenge

Power Grid earns fixed returns on the commissioned assets. Being a regulated entity, Power Grid earns fixed 15.5% RoE. Therefore, the company’s earnings depend a great deal on the capex it incurs. Any inability on the part of the company to maintain its capital expenditure could jeopardize its earnings potential. Power Grid has already spent a huge amount in the recent years which is significantly higher than the average annual CapEx levels. Analysts fear that the level of CapEx will go down in the coming years as most of its on-going projects will be commissioned by FY 18.

Capitalization of assets grew nearly 18% per annum on an average over the last five years. The earnings growth pace is also expected to be fast till FY 18 with a strong capitalization of assets. However, the pace could slow down post FY'18, with reducing the scope for large-scale transmission projects.

Another major concern for Power Grid is competitive bidding in the Indian power sector. The company could lose major orders if the competition intensifies.

Stock Valuation

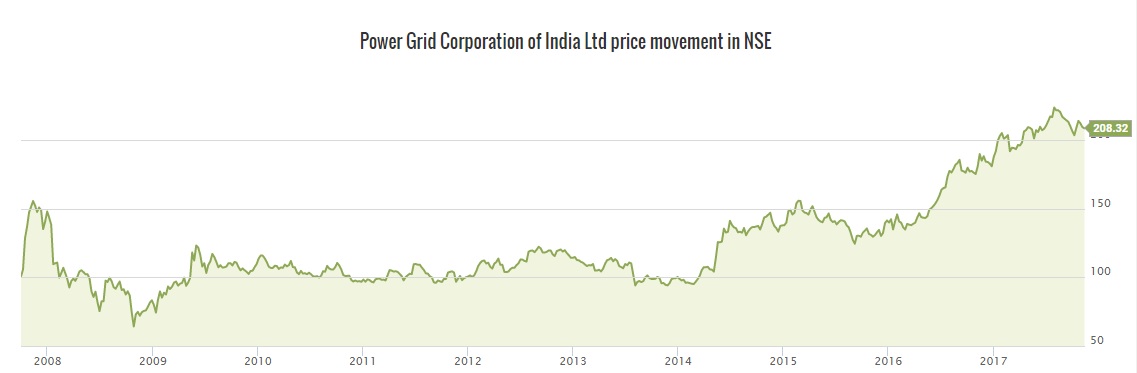

The stock has good growth prospects. At around INR 208, the Power Grid stock is trading at over 15 times its trailing twelve months earnings, which is less than the average Indian equity market P/E levels (24.48x). The company has a market capitalization value of INR 108,294 crore. The stock price has doubled since its listing in 2007 and should continue its growth trajectory given India’s huge power demand and Power Grid’s almost monopolistic like position in the Indian market.

Source: Edelweiss

Conclusion

India has achieved its ‘One Nation’-‘One Grid’-‘One Frequency’ objective in 2014.The Indian power system is one of the largest operating synchronous grids in the world today. This has helped the nation in optimum utilization of scarce natural resources and creating a national electricity market for facilitating the trading of power across regions and borders. Power Grid has played an important role in achieving this milestone. The company has further aggressive plans over the next few years involving the addition of new transmission lines and establishing interconnections with neighboring countries.

In my opinion, Power Grid Corp. is a good way to play the utility sector growth in India. Though stagnation is feared by analysts, it is not expected to creep in before FY'19. Investors could, therefore, look at adding the stocks on dips.

share your thoughts

Only registered users can comment. Please register to the website.