Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINInfibeam Incorporation Ltd. (NSE:INFIBEAM) is one of the leading e-commerce companies focusing on developing an integrated and synergistic e-commerce business model in India. It offers cloud-based e-commerce platform service in B2C and B2B verticals. The company operates through businesses - BuildaBazaar which is an e-commerce marketplace and Infibeam.com, one of India’s leading multi-category e-retailers. Infibeam.com reported 8.11 million active users and 15 million SKUs as of June 2017. Infibeam is gradually becoming a trusted name in retail and technology platform services, and a partner of choice for global businesses too.

Its integrated business model enables it to provide comprehensive and multi-channel value-added services to merchants. Advanced and scalable technology and relationship with established brands are its other key strengths.

Infibeam Positives

i) Diversified Products & Solutions – Infibeam operates different platforms ranging from retail to enterprise, digital, travel and logistics. Its retail platform offers millions of unique products across more than 46 category stores like mobile & tablet, books & magazines, computers & accessories, electronics, gifts, cameras, fashion & accessories, home & kitchen and many more. Its enterprise platform allows small, medium and large merchants a platform to start an online store under their own domain name. The company provides advanced hosting and technology infrastructure, search engine optimisations, affiliate marketing, e-mail and other digital marketing tools. Infibeam launched .ooo domain registry to attract new customers, and also set up a joint venture company with Sony Entertainment Ltd to develop, build and own software applications.

Infibeam has gradually increased its share of revenues from service offering raising it to 61% in Q1’18 from 31% in the last year.

ii) User friendly – Infibeam has made it easy to search products by city, price, brand, color and other product specific features. Customers can also compare products through product information, technical specification, images, prices and detailed customer reviews. The company uses sophisticated technology platform that supports multiple channels and screens, including mobile screens.

Infibeam offers same-day delivery through its logistics centers across 12 cities in India including in Mumbai, Bengaluru, Delhi, Gurgaon, Kolkata, Hyderabad, Guwahati, Jaipur, Pune, Lucknow, Ahmedabad, and Chennai. It also offers 24-hour customer care services.

iii) Acquisitions & Deals Further Strengthen Profile - Infibeam won the prestigious contract by the Government of India for design, development and operation & maintenance of ‘government e-marketplace’ (“GeM”). The company also acquired leading payment gateway service provider, CC Avenue this year, which should further integrate into an end-to-end e-commerce portfolio. To strengthen its global presence the company has also made an investment in RemitGuru, an international online money remittance service.

In addition, the company has also provided various enterprise customers and established brands with comprehensive digital business solutions including Unitech Amusement Parks Ltd, Panasonic India Private Ltd, Crossword Bookstores, Adlabs Entertainment, Gulf Oil Lubricants India Limited, Hidesign India Pvt Ltd etc. Infibeam is thus a chosen partner with established relationships across different industries in India.

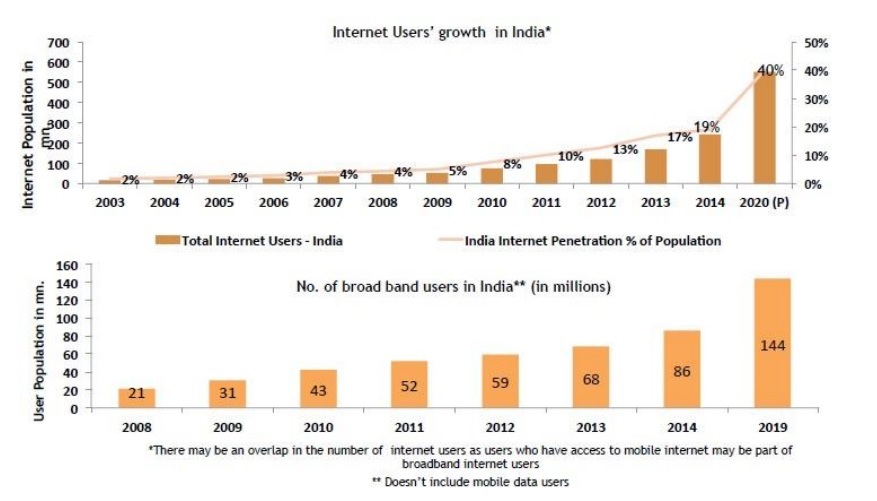

iv) Future Trends in India should support Growth – As a leading multi-category online retailer in India, Infibeam.com is in a good position to benefit from the growing trends of e-commerce ecosystem and growing internet users in India. E-tailing market in India is estimated to grow $44 billion by 2020 from just $7 billion in 2015. Increasing focus on digital payments market in India and an end-to-end e-commerce services demand should further drive future growth for Infibeam.

Source: Infibeam DHRP

v) First e-commerce IPO in India – Most e-commerce ventures are funded by private equity and venture capital firms in India. However, Infibeam is the first Indian online retailer to go public last year. It is the only largest e-commerce company that is listed. The INR 450 crore IPO last year was 1.11 times at the close. The primary purpose of the IPO was to buy office space and software, set up cloud data and 75 more logistics centers.

Infibeam Challenges

The e-commerce sector is considered a bit risky, given its low entry barrier. It is often lucrative to start an e-commerce business but difficult to sustain it. Most of these companies shut down as quickly as they start. This is the main dilemma for investors looking at investing in an e-commerce business. Leading e-commerce players in India like Snapdeal and Flipkart are also facing challenging times with Amazon.com rapidly capturing the Indian subcontinent.

Infibeam is a relatively unknown player in the industry which is dominated by the likes of Flipkart, Snapdeal, and Amaon.com in India. It thus faces immense competition from these leading players.

Moreover, the government policy on e-commerce is still unclear in India and adverse stances may inhibit the growth of e-commerce in India.

Infibeam Valuation

Currently trading near INR 180 levels, Infibeam enjoys a market capitalization value of INR 9,742 crores. The stock has a high P/E value of 144 times. The valuation is generally high for e-commerce firms. It is difficult to compare Infibeam’s stock performance with peers since none of the e-commerce players are listed on the Indian stock exchange. Though the stock looks expensive currently, it offers a good way to play the growing e-commerce marketplace in India. Analysts are expecting the stock to near the INR 200 mark.

I would, therefore, advice investors to buy on dips.

Conclusion

More than 50% of India’s growing GDP is expected to be constituted by private consumption of which 50% will be comprised of the retail segment. Infibeam thus has a large prospective market at hand. Established Infibeam.com brand, a wide range of products and services, sophisticated technology, significant consumer reach, strong supply chain and inventory management, and cost-effective fulfillment are the company’s key strengths. It provides affordable technology to solve large-scale business problems. The company has reported revenue growth quarter after quarter with the latest quarter growth of 76% y/y. I think Infibeam is a good way to profit from the rising e-commerce market in India. The valuation is expensive but is justified given the expected explosive growth of e-tail in India.

share your thoughts

Only registered users can comment. Please register to the website.