Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINAxis Bank (NSE:AXISBANK) is the third largest bank in India offering a wide range of financial services to a diversified customer base. The bank started operation in 1994 and today ranks amongst the most valuable brands in India. More than 46% of the bank’s shares are held by foreign institutions followed by 13% held by life insurance corporations and 10% by other Indian institutions. It also has a higher market share in digital and new technology products space. As one of the leading private sector banks, Axis Bank is a safe way to invest in the long-term secular growth of the Indian economy. Let’s have a closer look at the stock.

Axis Bank Positives

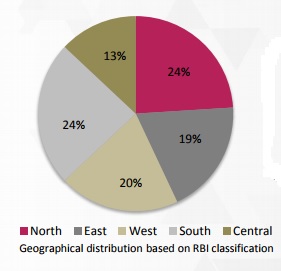

i) Large Geographical Footprint with a Diversified Customer Base – As of March 2017, the bank has an intensive network consisting of 3,304 domestic branches and 14,163 ATMs across the country. Around 20% of its branches are in rural areas and 74% of its rural branches are in unbanked locations. This gives Axis Bank to grab potential market share in these locations. Axis Bank also has an international presence extending to Singapore, Hong Kong, Dubai, Colombo, Shanghai, Dhaka, Dubai, Abu Dhabi and London. The bank serves diversified customers ranging from large and mid-corporates, MSME to agriculture and retail businesses.

Axis Bank Branch Distribution

Source: Axis Bank Investor Presentation

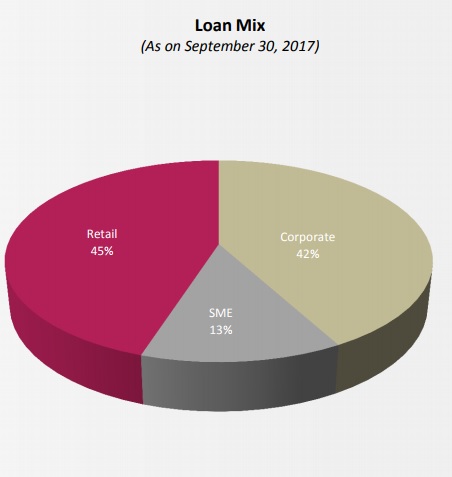

ii) Strong Focus on Retail Banking – Axis Bank has a strong focus on the retail segment which has continued to be a key driver in the Bank’s overall growth strategy. High-quality products and services, usage of technology, long-term customer relationships are its key advantages. Savings Bank deposits have grown at a CAGR of 21% over the last five years and have crossed the INR one lac crores mark. The bank owns over 170 lac savings account customers. The Bank has continued to increase its share of retail loans to total advances and its retail loans portfolio continues to focus on secured products. Secured loan products accounted for 86% of retail loans and are well diversified as follows - home loans (45%), retail agricultural loans (17%), auto loans (9%), property loans (8%), personal loans and credit cards (11%), and others (10%).

Axis Bank Loan Mix

Source: Axis Bank Investor Presentation

Axis Bank has a stringent corporate lending policy focussing on higher rated corporates, with 63% of outstanding corporate loans to companies rated ‘A’ and above.

iii) Strong Digital Growth and Product Portfolio – The Bank is witnessing a strong adoption of digital channels by customers. About 87% of the bank’s retail transactions are now through electronic channels. Axis Bank’s Internet Banking user base is also growing at 23% y/y. Its mobile application has also shown a good growth momentum with 25 lac user base. The bank is one of the largest debit card issuers and the fourth largest credit card issuer in the country. It is also growing its online presence with a 54% annual growth in volumes from e-commerce merchants. Axis bank also offers a suite of banking and investment products for its NRI customers. Its NRI deposits also registered a growth of 6% y/y. The Bank has a market leadership position in Travel Currency Cards. Other than the usual retail banking products, it also offers a wide range of forex and remittances products to its retail customers.

iv) Consistent Growth Over the Years – Over the last five years, Axis Bank has posted a growth of 16% in total assets, 13% in total deposits, 17% in total advances, compounded annually. For its recent quarter, the bank’s earnings rose by 35.5% y/y. In addition, the bank has also shown significant growth in customer additions and consistently gained market share over the past few years.

Axis Bank’s Challenges

Some of Axis Bank’s legacy issues include its quality of the asset and transparent reporting. Though the bank maintains a decent retail and corporate loan portfolio, it still reported an increase in its quarterly gross non-performing assets to more than INR 27,402 crore as of September compared to INR 16,370 crore a year ago. Compare this to its two years ago-NPA level of INR 4,451 crore. The bank’s NPA ratio rose to 5.9% in July-September from 5.03% in the preceding quarter. The increase was majorly due to the RBI’s asset classification exercise for fiscal 2017. Analysts are expecting the normalization of the stress should begin from the second half of FY19. India’s bad loans problem is getting worse with many leading banks reporting dismal NPA numbers.

Valuation

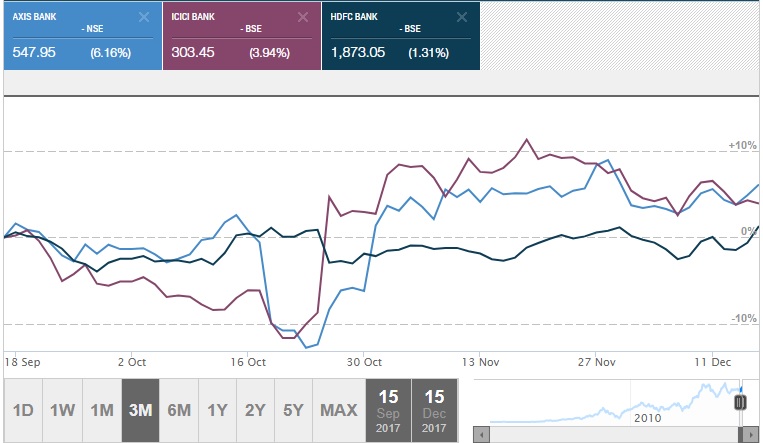

Shares of Axis Bank are currently trading near the INR 550 mark, almost 14% below its 52-week high. The stock regained sharply by 22% after sliding in mid-October. The bank has a market capitalization value of INR 131,464 crores, and a P/B of 2.3x which is better than HDFC Bank’s (NSE:HDFCBANK) 5.2x. Axis Bank’s shares also gave better returns than its peers ICICI Bank (NSE:ICICIBANK) and HDFC Bank over the last three months.

Source: Money Control

Conclusion

As one of the country’s major private lenders, Axis Bank is steadily improving its market share. Axis Bank’s stable retail-focused deposit base and low-cost current and savings account is one of the industry’s best. The bank’s focus on finer retail segments such as microfinance, personal loans, small business banking, loan against property etc. is also praiseworthy. All these factors are the bank’s key differentiators when compared to other Indian PSU banks. Given the bank’s growth in advances, reduction in provision, a balanced asset portfolio and a reasonable valuation (compared to other leading private players), Axis Bank shares are a worth a glance.

share your thoughts

Only registered users can comment. Please register to the website.