Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINSpiceJet Ltd. (NSE:MODILUFT) is one of India’s leading low-cost airlines. It has not only consolidated itself as being a leading domestic and international airline company, but also operates the country’s largest regional fleet. SpiceJet flies 50,200 passengers through its 402 flights across 51 destinations (45 domestic and 7 international) on a daily basis. With just over a decade of existence, SpiceJet has a remarkable turnaround story to tell. The company rebounded from the verge of downing shutters to becoming one of the most valued Indian airline company. It has had a good FY 2017 and is all set to rock 2018 as well, with new launches and new routes.

SpiceJet Positives

i) A Dynamic Fare Structure – Spicejet offers economical fares to its flyers. Cost of a ticket is one of the most important factors that a traveler keeps in mind while choosing an airline. In fact, in a highly competitive Indian airline market with cost-sensitive customer base, the cheap ticket price is one major factor that lures customers. SpiceJet ranks quite high on the list of low-cost airline companies in India.

ii) Impressive Fleet - SpiceJet operates a fleet of Boeing and Bombardier Q-400s. The new-generation Boeing fleet, consisting of 38 aircraft, allow for safe and efficient flying for short to medium-haul flights in India. It is the primary fleet that operates in key destinations in tier I and II cities. Bombardier Q400s, consisting of 22 aircraft, are known for their fuel efficiency and are also designed for short-haul routes. The entire fleet is suited for greater efficiency to support its low-cost structure. The company plans to add 12-15 Boeing 737 aircraft and 6-9 Bombardier Q400 aircraft to its existing fleet, before December 2018. The new fleet is expected to deliver cost cuts by around 8-9% on each aircraft, through improved efficiency and increased seating capacity.

iii) Impressive Turnaround – SpiceJet has proven its resilience by completely turning around from a dwindling reputation to becoming one of India’s most preferred airlines. It requires a great zeal and hard efforts to regain customer confidence. Not only has the airline company registered a capacity growth of 7%, but it has also grown its number of passengers at 13% CAGR over the last two years. It also became the No.1 airline in on-time performance during FY 2016-17.

iv) Improving Metrics – SpiceJet has recorded second consecutive year of profitability. It has also maintained industry leading load factor of over 90% for 2 years in a row. It outperformed its peers in international and domestic passenger growth. The airline company is also expanding and has increased its daily flights by 21% and added 24 new routes in FY 2016-17. SpiceJet has also placed an order for up to 205 Boeing 737MAX and wide-bodied aircraft which is the single largest order placed by an Indian airline in Boeing’s history.

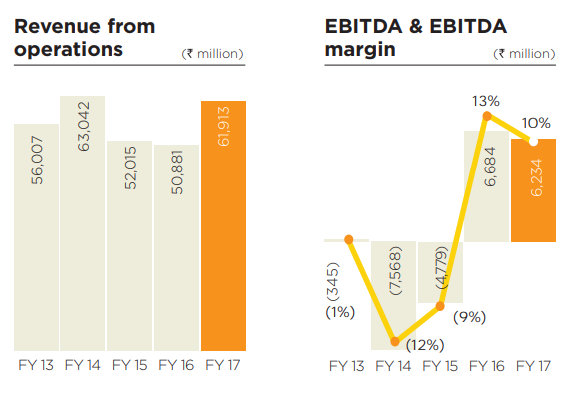

Source: SpiceJet Annual Report

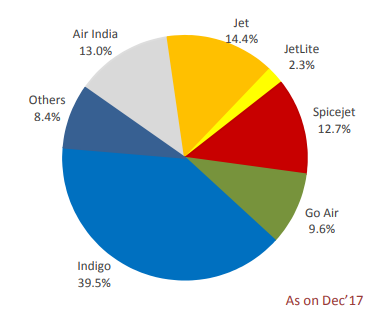

v) Improving Dynamics of the Indian Market – India is the fastest growing aviation market in the world. Indian economy grew at 7.1% in FY 2016-17. With increasing population, improving lifestyle and cheap airfares, there has been a surge in the number of passengers willing to take airplanes rather than railway trains. The government is also promoting various regional connectivity schemes like UDAN (Ude Desh Ka Aam Naagrik) scheme. SpiceJet is set to benefit from this growing market and also has a huge potential to grab market share as it currently commands only 12.7% of the Indian market. Moreover, the privatization of Air India could improve domestic airline companies' international traffic share.

Source: SpiceJet Q3’17 Presentation

Key Risks

a) An intense competition in the Indian aviation market – SpiceJet suffers from increased competition from peers in India. There are many airline carriers which promise low-cost fares to Indian flyers. Being a cost-sensitive market, the majority of Indian flyers choose a low-cost carrier. Though SpiceJet ranks amongst the top low-cost Indian carriers, it faces intense pressure in the cut-throat Indian aviation market because of irrational pricing behavior.

b) Rising Fuel prices – Rising fuel prices have been a major headache for airlines, adversely affecting profitability. Fuel prices constitute the largest part of operating costs and are also beyond control. In fact, expenditure on aircraft fuel increased by 33% in FY 2016-17.

c) Other Risks – Lack of adequate infrastructure facilities and currency fluctuations are other risks. Infrastructure remains the biggest challenge for India because the country is unable to keep pace with rising demand.

Stock Performance & Valuation

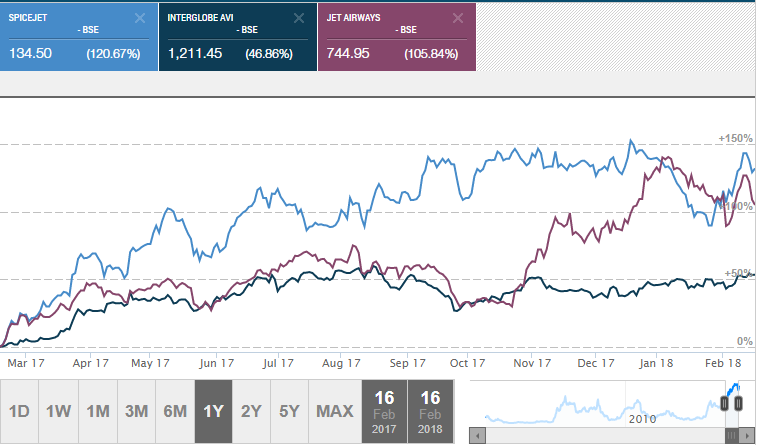

SpiceJet shares are currently trading near INR 143 level, just 9% below its 52-week high. It has a current market capitalization value of INR 8,599 crores and a P/E of 15x, which is lower than the industry average of 26x. The stock performance has also been better than peers like Jet Airways Ltd. (NSE:JETAIRWAYS) and Interglobe Aviation Ltd. (NSE:INDIGO) as can be seen below.

Source: Money Control

Conclusion

India became the third largest market in 2016 in terms of domestic air passenger traffic, with 100 million domestic flyers. The country has witnessed an impressive 22% growth in domestic travel in FY 2016-17. SpiceJet is definitely set to benefit from the aviation revolution in India. The company is already investing heavily by adding new routes and launching flights on regional routes. SpiceJet has also reported improvement in profitability in 2017 (and also since every quarter it was taken over). 2018 should be a big year for the company with new plane deliveries, which are further expected to reduce cost. The stock also is trading at reasonable valuations when compared to leading industry peers. Given its remarkable turnaround, improving profitability and future plans, investors with a long-term outlook can look at buying SpiceJet at dips.

share your thoughts

Only registered users can comment. Please register to the website.