Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINHero MotoCorp. Ltd. (NSE:HEROMOTOCO) was incorporated in 1984 as a joint venture company between Honda Motor Company of Japan and Hero Group (however, the JV was later terminated in 2011). Hero MotoCorp. Ltd (formerly known as Hero Honda) continues to be the largest two-wheeler manufacturer in the world for the last sixteen years, manufacturing bikes for every segment in the two-wheeler vehicle range. It has become a popular brand name not only in India but also abroad. The company has successfully positioned itself as a leading global mobility solutions provider with more than 70 million customers across geographies. Hero Motocorp commenced commercial production at Vadodara plant with a capacity of 1.2 million units annually, which will gradually increase to 1.8 million units. In addition, the company has manufacturing facilities at different locations in India, Colombia and another one coming up in Bangladesh. The company is poised to post double-digit volume growth in the coming years driven by growing Indian economy and rural demand growth.

Hero MotoCorp. Positives

i) Diversified Portfolio of Products - Hero MotoCorp is a market leader in India in the two wheeler segment. The company has a diversified range of product offering in each of the two-wheeler vehicle category. The company offers a range of bikes like CD Dawn, CD Deluxe, Splendor Plus, Splendor NXG, Passion and Passion Pro and other models in the 100, 125, 135 and 150 cc range. While Hero MotoCorp is a clear leader in the motorcycle segment it is also making strong inroads in the scooter segment with the launch of many new scooters. The company focuses on launching demographically oriented products as well as using its global production excellence to power innovation and brand eminence.

ii) Extensive Reach in Growing India – Hero MotoCorp has an extensive footprint in India and is also expanding its distribution networks. The company has an extensive sales and service network spanning all over India. Hero MotoCorp has played a huge role in India’s industrial transformation since the last three decades. India is currently witnessing strong economical and politically stable conditions with reducing inflation and a stable GDP. Make in India, rising middle-class income, rapid urbanization and boost in rural economy are other factors supporting growth. The company also has an international presence in 35 countries across Asia, Africa and South and Central America.

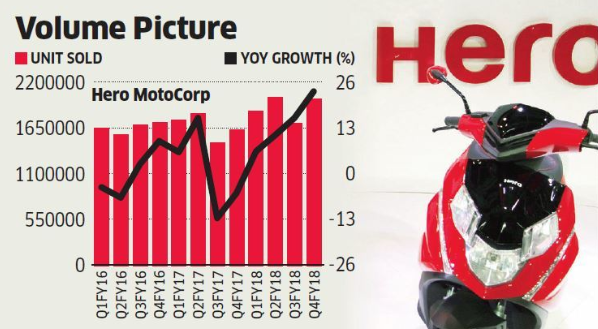

Volume Growth

Image credit: Economic Times

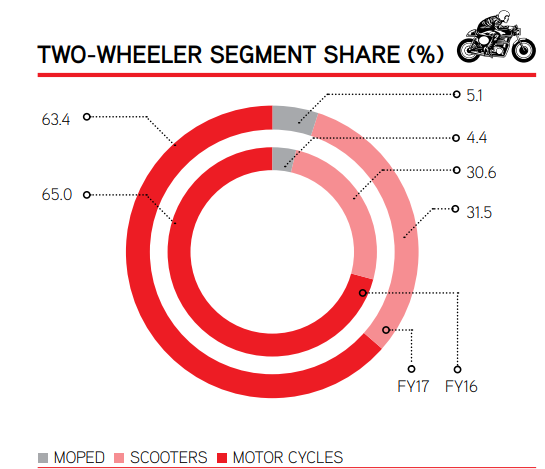

iii) Leader in the Indian Motorcycle segment – Starting out as a bicycle manufacturer, today Hero Motocorp commands more than 50% motorcycle market share in India. The motorcycle sales in the country is growing at a fast pace at almost 30% annually and motorcycles continue to dominate the domestic two-wheeler industry with over 60% market share. Hero Motors’ Splendor is the best seller, particularly in rural India. Four out of the top ten best-selling motorcycles in India belonged to the Hero family.

Hero Motocorp Annual Report

iv) Gaining marketshare in the Premium segment – Hero MotoCorp is aiming at gaining marketshare aggressively in the premium segment too. The company recently launched Xtreme 200R in the premium range, which was indigenously developed and is, therefore, contributing towards the Make in India initiative too. The company is expected to launch many more models in the premium segment in 2018.

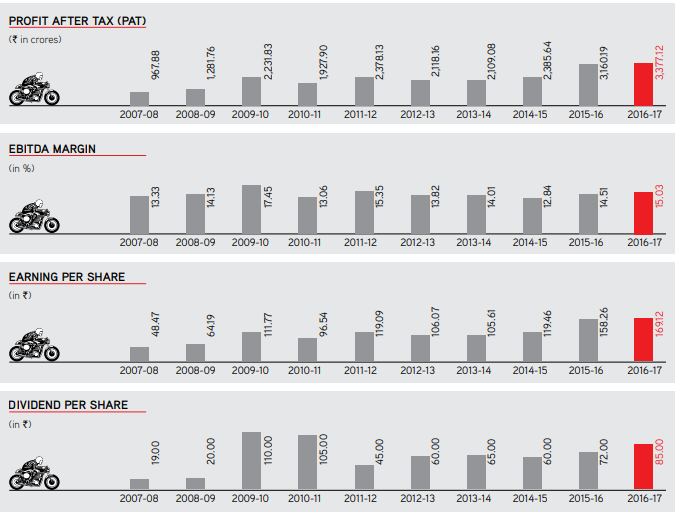

v) Improving metrics – The company has grown at a double-digit pace since its inception, owing to its fuel-efficient motorcycles and Japanese technology. For FY18, Hero Motocorp’s net profit increased by 9.5% on strong volume growth. The company is expected to post further gains on positive rural sentiments. The company’s revenue grew 23% in the latest March quarter, selling a whopping 7.3 lakh units of two-wheelers in the month. Its Q4’18 numbers were in line with estimates. Hero Motocorp is expecting double-digit volume growth for FY19 and registered a ~14% growth in unit sales in FY18.

Hero Motocorp Annual Report

Pawan Munjal, Chairman & Managing Director, Hero MotoCorp Ltd, said, “The fiscal year 2018 proved to be yet another year of record performances and landmark achievements – be it domestic sales, global expansion or in the field of research & development, manufacturing excellence and technological innovations at Hero MotoCorp and its alliances. We are clearly focused on sustaining our leadership in the market and consistently keep increasing wealth for our investors.”

Source: Economic Times

Key Risks

a) Falling marketshare in the scooter segment – Honda Scooters is the leader in the Indian scooter market. Hero Motocorp sold 7.9 lakh scooters in 2016-17 as against 8.19 lakh units in 2015-16. Scooters account for nearly 12% of Hero MotoCorp’s overall volumes. India has a huge demand for scooters where they command more than 30% of the overall market share. Hero currently commands 36% of the two-wheeler segment marketshare, declining from 45% in 2010-11. Much of the fall in marketshare can be attributed to declining scooter sales.

FY 18 FY 12

Scooters 33% 20%

Motorcycles 37% 49%

Rising marketshare of Scooters in the Indian Two-wheeler market segment

b) Close Rivalry in the Indian market - Once partners, Hero MotoCorp and Honda Motors have now become close rivals in the two-wheeler segment in India.

Two-Wheeler Motorcycle Scooter

Hero Motors 36.9% 51.1% 13%

Honda Motors & Scooter India 29% 15.7% 57.3%

c) Rise of electric bikes – With growing concerns about the climate, India like many other countries has vowed to resort to methods to reduce emissions and save the environment. As a result, the country is focusing on launching more electric vehicles in the coming decade. This could dampen Hero Motocorp’s sales in case, demand for electric bikes/ scooters catches up or is mandated by the government. However, the company has an EV programme in place which was started a few years back. It is also engaging with the external ecosystem and start-ups in this regard and has invested INR 200 crore in Ather Energy for an equity stake of 30% to promote smart electric scooters in India.

Other than these automobile stocks also suffer from adverse international rulings, the latest one being a probe by US President on Chinese imports of automobiles and auto parts in the USA. Forecast of low rainfall in India might also dampen rural sales.

Valuation

Shares of Hero Motocorp have rallied over the last five years and are currently trading at INR 3,600, more than double from the INR 1,600 mark. Hero Motocorp is a large cap company with a market cap of more than INR 70,000 crore. Its trailing P/E stands at 19.3x which is lower than the industry average of 21x. The company also distributes dividends to its shareholders and has improved the dividend pay-out for most of the years.

Conclusion

Hero Motocorp is a recognized brand name and has a global reputation for sturdy as well as fuel efficient two wheelers. The company also has a robust product pipeline and is setting benchmarks in technology and quality. The company has planned investment towards new product development, digitization, phase-wise capacity installation and expansion in the upcoming years. Hero motorcycles are the best selling bikes in India and the company should continue on its growth trajectory, given the huge growing market for two wheelers in India and a good monsoon prediction this year. Investors can look at adding on dips.

share your thoughts

Only registered users can comment. Please register to the website.