Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINBerger Paints India (NSE:BERGEPAINT) is the second largest paint company in India after Asian Paints (NSE:ASIANPAINT). The company started operations in 1928 in India and has become the leader in Protective coatings segment today. The company has a presence in almost all segments of paint industry - the decorative, general industrial and automotive, protective coatings and powder businesses. The decorative paints account for over 70% of the paint market in India and are growing at a faster pace than industrial paints. Berger Paints is known for providing a hassle-free painting experience and has products serving both residential and industrial sectors. The company should benefit from improving macroeconomics in India.

i) Extensive Footprint - With 88-year-old history in India, Berger Paints has 10 strategically located manufacturing units in the country. The company has tied up with 66 stock points across India as a result has a large distribution network in almost all corners of India. It also has an international presence in Nepal, Bangladesh, Poland, and Russia. Berger Paints is further increasing its capacity and is building an integrated paint plant in Uttar Pradesh’s Sandila industrial area, which is expected to get completed by the start of 2020.

ii) Large Portfolio of products – Berger Paints is the proud owner of a large portfolio of paint products in every paint segment. The company also provides tailor-made customer services which includes on-site technical support, trained applicators, mechanized tools and advanced products for faster, cleaner and better results. Berger Paints ensures 40% faster services than traditional painting and uses cutting-edge vacuum machines to keep one’s house dust-free. Some of its innovative products and services are Berger Express painting, weathercoat long life, weathercoat anti dustt and anti dustt clear. The company continuously endeavours to manufacture products with low maintenance requirements and low carbon footprints. The company is also planning to enter the glass and wood coatings segment this year.

Berger Paints innovative and indigenous R&D technologies have made it a leading player in the industry. Some of the company’s popular products are Rangoll Total Care, Silk Luxury Emulsion, Weather Coat All Guard, Breath Easy and Easy Clean.

iii) Diverse Customer base – Berger Paints has a bouquet of paints and coating solutions to cater to the needs of both residential and industrial sectors. In the industrial sector, the company manufactures coating solutions for metal fittings in various industries including automobiles and OEMs. These coats provide an essential finish to industrial parts and products and must follow strict industrial compliances. To fortify its industrial presence in India and other neighbouring countries, Berger Paints has entered into two MoUs in the field of passive fire protective coatings, and Marine and related industrial paints.

iv) Favorable Macroeconomics in India – India is one of the fastest growing developing economies in the world. The country is witnessing increasing trends of rising consumerism with increasing levels of disposable income. India’s economy has also strengthened with strong policies by the Government at the center. India’s Make in India, affordable housing scheme, demand for roads, bridges, new buildings, and dams should further boost the paints and coatings market. The growth prospects of the industry continue to be optimistic and the industry expects the demand to exceed INR 70,000 crores by 2019-20. By segments, the industry expects the decorative paint market to grow at a CAGR of 14%+ and the industrial paint market at a CAGR of 9.5% by value. Berger Paints is well-positioned to take advantage of this growth scenario.

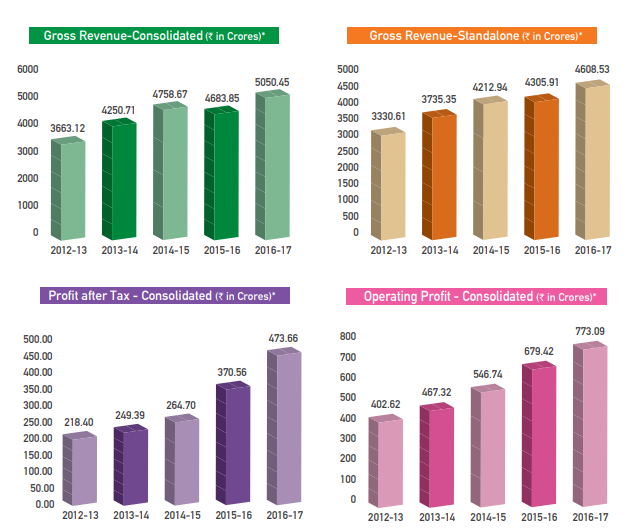

v) Improving Metrics – Berger Paints is one of the fastest growing companies in the paint sector. The company has demonstrated strength in almost all of its financial metrics over the years, as can be seen below. The company reported an increase in both revenues and profits for its latest quarter driven by strength in sales network, dealers, and better product mix. The company has also rewarded its shareholders with handsome dividend payouts and also has a share buyback program.

Source: Berger Paints Annual Report

Challenges

The cost of Titanium dioxide (TiO2) which is the key raw material for paint companies is following a rising curve. The industry expects prices will continue to move northwards over the coming quarters as well. Cost of other raw material such as monomers and crude oil derivatives have also been rising given the crude oil price hike.

As a result of increasing raw material cost, the company has resorted to product price hikes which might not be well-received by its customers.

Currency movement fluctuation is also one of the key challenges for Berger Paints since most of the raw materials are imported.

Apart from these factors, Berger Paints also faces stiff competition in the paint market. The market capitalization value of Asian Paints, which is the leading paints company in India, is almost five times greater than that of Berger Paints indicating that the latter has a long way to go to attain industry-leading position. However, it is one of the top interior paint brands in India and is better positioned than peers like Nerolac, Dulux, Shalimar etc.

Valuation

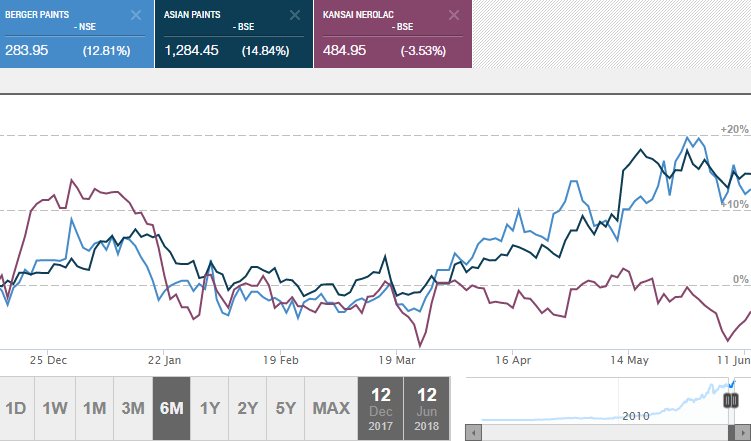

Shares of Berger Paints are currently trading near INR 285 levels. The company has a market capitalization value of INR 27,600 crores and trades near a P/B of 11.7x, which is lower than Asian Paints P/B of 14x. The current valuations seem to factor in near-term positives. Shares have shown an upward movement so far this year and have gained by more than 14% in the last six months. Berger Paints has returned more than thrice its value, over the last five years and shown far better performance than peers like Kansai Nerolac (NSE:KANSAINER).

Source: Money Control

Conclusion

Berger Paints is in a good position to benefit from the projected growth in the paint industry. The company is a clear leader in the decorative and automotive segments and expects margins to improve in the industrial business too. Tailor-made products and services, innovation at all levels, expanding footprint in new geographies and market segments, extensive distribution and logistics are key competitive strengths. Though shares are trading just 7% shy of the 52-week price, they come at a bargain when compared to Asian Paints. Berger Paints is a good way to invest in the Indian paint industry, given an increase in consumer spending and improving Indian economic growth. Investors must however, be careful as the company is extremely sensitive to the oil price movement.

share your thoughts

Only registered users can comment. Please register to the website.