Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINBajaj Auto (NSE: BAJAJ-AUTO) is a flagship company of the Bajaj Group in India. Bajaj Group is one of the ten largest business conglomerates in India. The group has a vast presence across various industries spanning automobiles (two wheelers and three wheelers), home appliances, lighting, iron and steel, insurance, travel, and finance. Bajaj Auto is the fourth largest three and two wheeler manufacturer globally. The company has gained popularity not only in India but is also driven in 70 other countries worldwide, owing to its broad portfolio of quality products and a trusted brand name. Though the company has suffered due to stiff competition, an improvement in the export and domestic market and new product launches are expected to boost the bottom line. It is a good time for investors to build a position in Bajaj Auto owing attractive valuations and growing visibility from export volumes. Let's take a closer look at the company.

Bajaj Auto Positives

i) Huge Geographical presence - Bajaj Auto not only has a wide footprint in India but also in several other countries like Latin America, Africa, Middle East, South and South-East Asia. The company accounts for nearly half of the total two-wheeler exports from India and also commands a 58% market share in the domestic three-wheeler segment. For passenger and goods carriers, its market share is 67% and 19% respectively. Bajaj Auto has an extensive distribution network and uses differentiated marketing strategies targeting different demographics and geographies. The company deploys authorized distributors and company-owned sales & service outlets, direct selling agents and e-commerce sites. This helps Bajaj Auto to access even the rural parts of India, which are huge drivers for motorcycle demand growth.

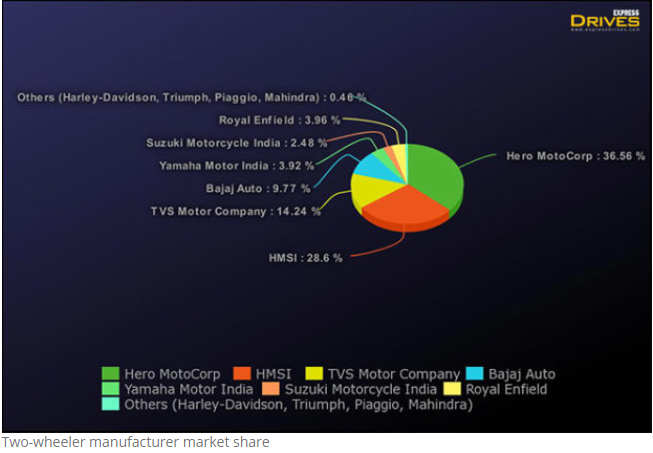

Bajaj Auto Market Share

ii) Extensive knowledge and rich experience - The Bajaj Group has been around since 1926 and has accumulated a rich experience and knowledge about the Indian market since then. Bajaj Auto has a large dealer network spanning across the country and commands a high market share in both petrol and diesel category. An experienced management team and a rich R&D base have enabled the company to make prompt strategic moves and launch successful products one after another. For instance, its KTM brand of motorcycles is the fastest growing brand of motorcycles in India and registered a growth of 30%+ in FY18. With more than seven decades of existence, the Bajaj brand has earned the trust of millions of Indians for its product quality, safety, and reliability.

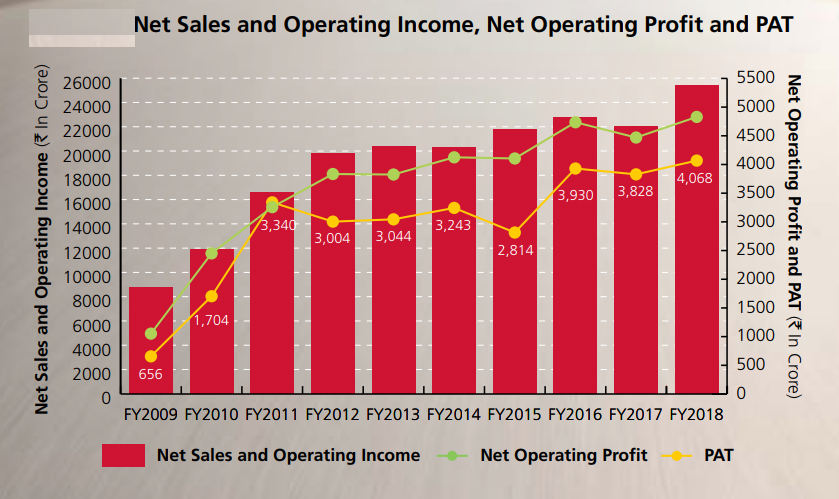

iii) Good Financial Performance - Under the leadership of the present chairman, Bajaj Auto has increased its turnover manifold to from INR 72 million to INR 120 billion currently. The company reported an increase of over 15% y/y during FY18. Prior to that, Bajaj Auto was facing challenges in growing its export volume. But owing to the resurgent oil prices, the export volume has rebounded. Baja Auto witnessed an export volume growth of 20% in the two wheeler segment, over the past fiscal year. Motorcycle and three-wheeler exports also grew by ~25% and ~70% over the first quarter of FY19, respectively. The two-wheeler domestic market share improved by more than 10% during the same time. The company has guided export volume to increase by 15% y-o-y in FY19.

Bajaj Auto Annual Report

iv) Diversified Businesses - Bajaj Auto is the largest Indian player in the three wheeler commercial segment. The company manufactures a wide range of passenger as well as goods carriers. The company products cater to a wide range of customers in the residential, commercial and industrial segments. Other than its own brand of motorcycle, Bajaj Auto also owns the KTM range of products (with a 48% stake in the Australian bike maker KTM) which is gaining traction both in the national and international markets. To further strengthen its hold in the passenger carrier segment, Bajaj Auto is looking at launching the 216cc quadricycle which will be offered as an upgrade to the autorickshaws.

|

Sales H1 2017-18 |

Domestic |

% of Total |

Export |

% of Total |

Total |

|

Motorcycle segment |

10,10,559 |

60 |

6,83,876 |

40 |

16,94,435 |

|

Commercial vehicle segment |

1,37,285 |

52 |

1,28,224 |

48 |

2,65,509 |

|

11,47,844 |

59 |

8,12,100 |

41 |

19,59,944 |

Bajaj Auto Product segmentation based on recent sales

Bajaj Auto Challenges

a) Increased Competition in the motorcycle segment - Bajaj Auto faces severe competition in its motorcycle segment. Overall Bajaj Auto's market share in the domestic motorcycle segment fell to 15.7% in 2017-18 from 18% in 2016-17, owing to increasing competition. The company’s market share in the premium motorcycle segment significantly dropped to nearly 30% from 90% fifteen years ago. HMSI and Royal Enfield have increasingly been replacing the Pulsar range from Bajaj Auto over the years. These companies have been constantly launching and refreshing their product portfolio in this segment. However, Bajaj Auto is trying to waive off the competition with the launch of new products. Its Dominar 400 is expected to compete with Royal Enfield in the premium category. Bajaj Auto has also increased its focus on entry (with products like CT 100, Platina and Discover 100/110) and mid-level (110-125cc) motorcycle segment, which has been successful in sporting a volume growth.

b) Absence in the commuter segment - Bajaj Auto has a strong portfolio in the mid, entry and premium range of motorcycles. But the challenge remains in the commuter segment (mini bikes, scooters etc.). This segment accounts for 1.6 million two-wheelers sold every month and is the largest two-wheeler segment in India. Currently, Bajaj offers Discover 125 and V in the commuter deluxe segment. Competitors like Hero MotoCorp, Honda and TVS are fast catching up. Scooter is the most convenient and hot-selling product in the Indian two-wheeler segment, but Bajaj Auto had exited the scooter segment almost a decade ago. However, in order to stay relevant in this segment. the company is looking at launching new attractive models (like Discover and, V in the 125cc category) at competitive prices over the next couple of years.

Other than these the company suffers from increasing cost of raw material like steel and aluminum.

Valuation

Shares of Bajaj Auto have rallied over the past decade. Currently, they are trading near the INR 2600 mark, which is 23% below its 52-week high. Baja Auto is a large-cap having a market capitalization value of INR 77,900 crores and a zero-debt company. Its P/E stands at 17x which is lower than the industry average of 20x. Bajaj Auto also pays regular dividends and has an impressive yield of 2.2%. The long term stock performance has also been good over the last five years.

Source: Moneycontrol

Conclusion

Bajaj Auto is a leading player in the three-wheeler and sports (with its Pulsars, Avengers, the Dominar 400 and the KTMs products) vehicle segment. It also enjoys the financial backing of the Bajaj Group which is a trusted brand name and has a strong footing in India. Bajaj Auto is in a better position to benefit from a growing two-wheeler market in India. It is eyeing a 20% market share in the domestic motorcycle market over the next two quarters, from 16% currently. The company is expecting strong quarterly sales owing to the upcoming festive season and strong rural demand. With sales of three wheelers, motorcycles and exports back on track, the company has set the pace for future growth. The bottom line should also be driven by new launches which are expected to take on rivals in the domestic market. Bajaj Auto is a good buy for the long-term and investors can take advantage of the recent pullback.

share your thoughts

Only registered users can comment. Please register to the website.