Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINMRF or Madras Rubber Factory Ltd. (NSE:MRF) is a leading tyre company in India. It ranks among the top 15 tyre manufacturers in the world. The company manufactures rubber products like tyres, treads, tubes and conveyor belts, and also has a presence in paints & coats, toys (Funskool India), motorsports and cricket training. The company was incorporated as a private company in November 1960.

ICRA expects the tyre industry to grow by 8%-10% during FY18-22. The Indian tyre industry is estimated to be approximately INR 60,000 crores in 2017-2018 and MRF stands a good chance to benefit from its leading position in the Indian market. The top eleven tyre companies’ account for more than 90% of the volume.

MRF operates through heavy, light and small commercial vehicle tyres, four and three wheeler, passenger & SUV, farm and motorcycle and scooter business segments. Its strong focus on the two-wheeler and passenger-car tyres replacement market should also drive profit margin in the coming 1-2 years. Good past performance, a strong dealer network and controlled prices are the company’s USPs.

MRF Competitive Advantages -

i) Strong Brand Recall - With humble beginnings as a rubber balloon factory in 1946, today MRF has carved a leading position in the tyre industry both in the domestic as well as international markets. With a long history in India, the company has developed unique insights into the country, its people, culture, customers, roads and trade channels. Quality improvement and customer satisfaction are MRF’s strong competitive advantages. MRF became the only tyre company to be awarded the “JD Power India Customer Satisfaction Original Equipment Tyres Award” for Passenger Cars and Utility Vehicles in 2018 for a record 13th time.

ii) Expanding Geographic footprint - The company has a huge global presence in more than 65 different countries with 180 different offices worldwide. It strong distribution network consists of 4000 plus strong dealer networks.

In India, the company is expanding its manufacturing capacity with its new plant in Gujarat which is expected to come online within the next two years’ time. The new factory will cater to both domestic and export markets. MRF Ltd. has manufacturing facilities for tyres, paints and coats in Tamil Nadu, Kerala and Goa. The company is also expanding its portfolio in specialty coatings products.

iii) Wide Product Portfolio - MRF is a tyre king as it manufactures tyres for different types of vehicles like passenger cars, two- and three-wheelers, trucks, farm vehicles, LCV etc. The company makes tyres for all leading car companies. MRF makes both manufacturer recommended as well as broader tyres. Manufacturer recommended tyres guarantee optimum performance and fuel efficiency, while broader tyres are bigger in size. MRF also makes tyres for the Indian defense services and Armed forces. The company enjoys a lead in the tyre replacement market which drives between 65%-70% of volumes in the tyre industry.

MRF can be credited with many firsts in the industry. The company pioneered the manufacturing of nylon tyres in India and had made tyres for Maruti Suzuki 800, India’s first modern passenger car. It also manufactured the first eco-friendly tyre in 2007.

Challenges

a) Rising Input costs - Tyres in India are primarily made of rubber, which has to be imported from other countries. A huge gap between domestic rubber production and demand continues to remain an area of concern. The recent Kerala flood might also impact cost as Kerala produces 90% of India’s natural rubber. MRF has its own rubber plants and has also acquired overseas plants and rubber plantations in rubber growing countries like Thailand, Cambodia and Vietnam in the past, in order to better handle the rising raw material costs.

b) Changing BS norms - Given the rising pollution levels in the country, India has decided to leapfrog to BS-VI standard from BS-IV presently. This has created additional pressure on the tyre companies who have to demonstrate agility in adapting to a volatile market situation.

c) Intense competition in the tyre industry - The company suffers stiff competition from the likes of JK Tyres, Apollo Tyres and Ceat. MRF, along with the other top two companies Apollo Tyres and JK Tyres account for 55% of the market share of the Indian tyre industry.

Valuation

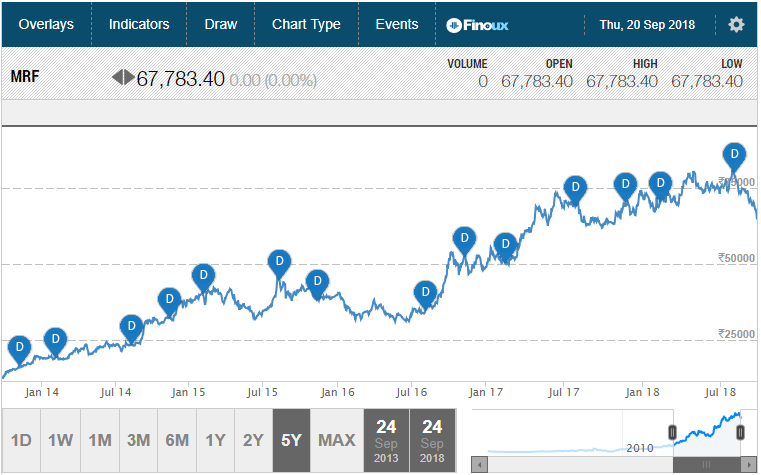

The shares of MRF Ltd. have shown a stupendous performance trading from near INR 500 levels in 2001 to INR 65,000 presently. MRF shares are trading at a P/E of 22.5x, which is lower than the industry PE of 24x. Shares of MRF Ltd. has corrected in recent times and has fallen by 15% over the last three months. Investors might be concerned about the high absolute share price, but given MRF’s strong business fundamentals and leading position in the growing tyre industry valuation is justified. Moreover, the stock has never undergone a share split in the past.

Source: Moneycontrol

MRF 5-year stock performance has been excellent

Conclusion

MRF is a leading tyre company in India and has posted double-digit growth over a long period. The company should benefit from good monsoons expected in India and strong infrastructural reforms such as road building. A favorable economic outlook, greater economic stability through GST and other structural reforms should drive growth for the tyre company. The domestic tyre volume growth is expected at a strong 8%-10% on the back of strong domestic sales volume growth in both commercial and personal vehicles in FY 2019. Analysts are betting big on MRF, given its efficient management and strong fundamentals. Though investors might want to wait for a share split in the future, the company has announced no formal plans as yet. This encourages only serious investments in MRF shares.

share your thoughts

Only registered users can comment. Please register to the website.