Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINCaplin Point Laboratories is one of the fastest growing mid-cap pharmaceutical companies in India. The company manufactures a wide range of tablets, capsules, ointments, creams, soft gels, and other external applications. It holds over 3100 product licenses across the globe and a wide range of products offered across diverse other geographies. Caplin Point is headquartered in the southern city of Chennai, with close access to its manufacturing and R&D units and the Chennai seaport. It also has a wholly-owned subsidiary, Caplin Steriles that deals in the global injectable markets. Caplin Point has a presence in the emerging markets of Africa, Latin America, and the Caribbean. The company derives 100% of its revenues from exports.

Advantages

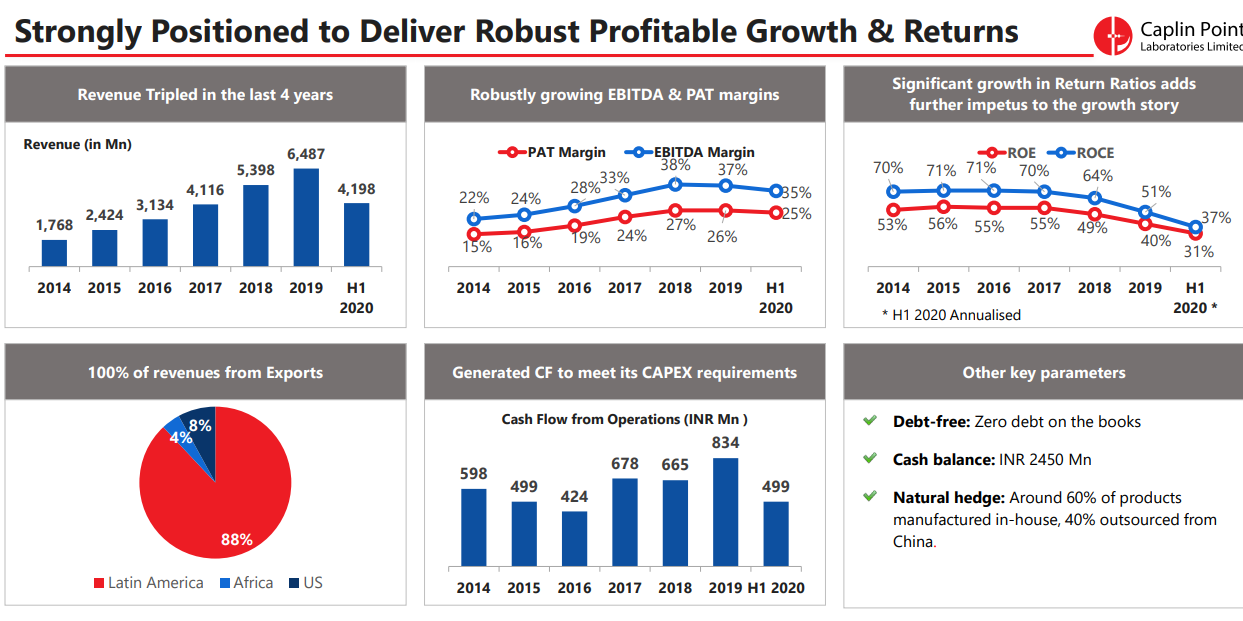

i) Growing international presence - Caplin Point has a dominant presence in the international market of Latin America. The company focuses on small geographies. The company derives the majority of its revenues (88% in 2019) from Latin America and the balance from Africa (4%) and the U.S. (8%). Caplin is now, however, shifting to larger economies such as the USA, China, Europe, Brazil, and Mexico. It covers the entire spectrum of pharmaceutical formulations with 400+ products, 36 therapeutic segments in 23 countries. Caplin Point has branches and subsidiaries in China and Hong Kong, and is in the process of establishing more subsidiaries in Colombia and other locations, as part of its expansion strategy. The company stands a good chance to expand into new niches in its core markets.

ii) Integrated Business Model - Caplin is one of the few Indian companies having a large presence in LATAM with an end-to-end business model. The company has a lean manufacturing model, wherein it manufactures 40% of products in-house and the rest is outsourced from facilities in China and India. Caplin’s API and formulation R&D would help it address multi-tier products. It operates through a robust distribution network working closely with pharmacists and trade intermediaries in its core markets. About 70% of its sales are through distributors. Caplin is, however, investing in its distribution network ensuring direct access to retailers and wholesalers which will further expand its reach.

iii) Improving Financial and Operating Performance - In FY 19, Caplin Point registered its 16th successive year of profitable growth with revenues growing by 21%. It has a consistent profit growth of 65.81% over the last five years. The company continued to report revenue growth in the mid-twenties percentage range. Caplin Point is targeting to increase the manufacturing capacity of its USFDA approved Injectables plant by three times starting from the second half of FY 2019-20. Branded Generic sales have also increased from 5% of revenues in 2012 to 25% now, ensuring the longevity of products and increased margins. Caplin Point is extending its business to clinical research, which should further establish it as a more broad-based player with relevance across a wider range of businesses and regions. The company is using technology to provide the most effective medicines at an affordable cost.

iv) Growing Need For Healthcare - As the global population increases, there is an ever-rising demand for quality healthcare. Caplin Point is favorably positioned to gain from a growing global population and an increasing demand for healthcare products. The global health care expenditure is projected to grow by more than 5% in 2017-2022. The developing economies have tremendous potential for growth driven by an increasing number of middle-class households, improving medical infrastructure and insurance. The company is also expanding into the tender-based business which should provide it an opportunity to enhance national visibility and credibility. The governments are the largest buyers of therapies in these markets. Caplin Point has filed 12 ANDAs to date with six approved and 10 more to be filed by Dec 2020 in the U.S.

Challenges

Caplin Point emerged as a first-moving Indian pharmaceutical company in South and Central America. At a point when the Indian pharmaceutical sector was generating less than 5% of its revenues from these markets, Caplin Point generated more than 80% of its revenues from this geography. The company has continued to widen its moat within this market and has emerged as a leading player. Now, the company is planning to enter the larger regulated markets, where it will face significant head-on competition. However, with expansion in the larger markets and horizontal and vertical integrations, the company is also expected to grow in the future.

Another pressing issue is increasing debtor days. The company has, however, resolved to maintain its debtor days at around 90 days.

Valuation

Shares of Caplin Point are currently trading near the Rs. 380 mark. The company has strong investment fundamentals with ROE and ROCE at 37% and 48% (respectively). The stock is trading at 11x its earnings which is cheaper than industry PE of 30x. Caplin Point’s market capitalization value is Rs. 2,200 crores. Caplin Point shares have grown at a rate of nearly 68% CAGR in the last decade. It has a debt-free business model. The company is capable of generating adequate revenue and cash flow to remain debt-free. Caplin Point has been paying regular dividends in the last nine years and sports a dividend yield of 0.7%. While the yield may not sound exciting the long payment history surely rings a bell.

Conclusion

Caplin Point is transitioning to a technology and research-led marketing company. The company continues to strengthen its market share position and product portfolio. Caplin Point is entering into the regulated markets of the US, EU, Brazil, Mexico, Australia. The company also has a strong pipeline for emerging markets. Its investment in API research should also deepen its presence in China. Given Caplin’s two-decade-long history in South America, the company stands a good chance to gain from the booming generics market in South America. Its continued investment in manufacturing, R&D, and digital capabilities should also support future growth.

share your thoughts

Only registered users can comment. Please register to the website.