Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINIntroduction

VIP Industries Ltd. is Asia’s largest and the world’s second largest luggage company and is being headquartered in Mumbai. It has more than 8000 retail outlets apart from well-developed network of retailers spanning across 50 countries. It is a leading manufacturer of hard and soft luggage in Asia, having a simple goal of making travel simple and convenient. Its umbrella of brands include VIP, Skybags, Carlton, Aristrocrat, Alfa and Caprese. State-of-the-art VIP Design Lab at Nasik has several international patents and design registrations to its credit. VIP Industries also has global footprint with products being available all over Middle East, the UK, USA, Germany, Spain, Italy and some selected African and South East Asian countries.

Growth Enablers of VIP Industries

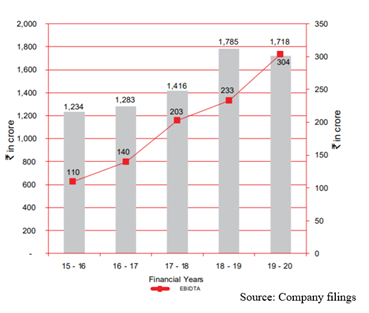

Indians Prefer to Shop Online- During FY20, revenues were INR1,718.32 crores as against INR1,784.66 crores during prior year, registering 3.72% decline. Sudden onset of Covid-19 in March adversely impacted sales for Q4 and negative impact on sales may continue. However, magnitude of impact should be less given re-opening of schools and the economy. Even though business saw an impact of COVID-19, revenues were higher than average revenues for FY16-FY19. All channels saw growth during FY20, with e-commerce seeing strongest growth amongst all channels. This suggests that Indian consumers now prefer shopping from home as compared to visiting markets. This trend should increase due to COVID-19.

Reduction in Dependency on China- VIP sources luggage and bags from factories in China and third-party vendors in India. It also manufactures its own products in plants present in India and Bangladesh. The company now plans to reduce purchases from China and increase production from India and Bangladesh. Sourcing from Bangladesh has increased to 100% from 55%.

Improvement Expected in 3Q21- In 4Q20, VIP Industries saw its gross margins at record high of 57.6% primarily because there was a decline in raw material costs. The company expects some recovery in business in 3Q21 because of festive period and marriage season. Complete lockdown of business activities in India is unlikely, and government has its focus on slowly re-opening the economy. Once international travel resumes, we expect rapid recovery as a result of pent-up demand. Therefore, by November or December, the company should see its business activities getting normalized. As per con-call for 4Q20, discounts are possible in post COVID-19 world just to support sales. To mitigate impact, ramp up in Bangladesh operations should be focused upon; this could result in improvement of profitability. Labour costs are relatively lower in Bangladesh. Thus, impact of discounts on margins should be minimal.

Adequate Liquidity- As per conference call for 1Q21, cash management is very important, and VIP has been paying creditors based on collections. It plans to ensure sufficient liquidity to pay off creditors if recovery in sales is slow. CRISIL has recently assigned 'CRISIL AA/Stable' rating to INR50 crore NCD programme. Further, credit rating agency has also reaffirmed ratings on INR100 crore NCD programme and bank facilities at 'CRISIL AA/Stable/CRISIL A1+'.

Industry Growth Should Help VIP- Indian tourism and hospitality industry is one of the key growth enablers among services sector. India is the most digitally advanced traveler nation. Several digital mechanisms are being used for planning and booking. Rising middle class and higher income should support growth of domestic and outbound tourism. Hotel and Tourism sector saw cumulative FDI inflow of USD15.28 billion between April 2000 and March 2020. We expect re-opening of Indian economy and relaxation of international travel to help hospitality and tourism sector. With growth in e-commerce channel, adequate liquidity position, market leadership and strong brand position, we expect VIP to capitalize on structural dynamics of the industry.

Minimal Impact of Tough Market Conditions- Relaxation of restrictions should help VIP Industries in 2H21 and cost rationalization should play an essential role. Cost cutting initiatives and favorable raw material prices should lend support to operating profitability. We expect VIP to absorb impact of slowdown as shift in consumer preference for branded luggage and healthy balance sheet are likely to act as growth enablers. Leading market position is an added advantage. These stressed business conditions are temporary and impact should now be minimal as Indian government focuses to end lockdown and bring business activities back on track.

Focus on Cost Rationalisation

At closing price of INR290.05, VIP Industries has a market capitalization of ~INR4,09,890.87 lakhs and has healthy credit metrics. The company has compounded its revenue at ~8.62% while EBITDA has been compounded at ~28.93% over FY16-FY20. Cost rationalization was prime focus for 1Q21 and the company saw reduction in fixed overheads by 35%. Measures supporting reduction were decrease in rent, store closure, rationalisation in manpower cost and eliminating all discretionary spends. These cost measures are likely to support the company throughout FY21 and should also help profits.

Travel forms an integral part of human existence. Travel should be back on track as India and World adapts to new normal. VIP is exploring new opportunities in PPE segment which should have higher demand for ~12 months.

Conclusion

VIP Industries should also prepare itself for short-term challenges. Apart from COVID-19, the company is exposed to Chinese imports as well. It sources luggage and bags from Chinese factories. However, it expects to reduce purchases from China. Any company having sound balance sheet and market leadership should be able to overcome present stressed conditions. These conditions are here for short-term and gradual improvement should benefit the companies with sound financial viability. VIP Industries is one such company, having strong distribution network and healthy credit metrics. Additional capital can also be raised without much impact on balance sheet. All these factors should help it tide over these challenges.

share your thoughts

Only registered users can comment. Please register to the website.