Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINMCX or Multi Commodity Exchange of India Ltd.(NSE:MCX) is a leading commodity derivatives exchange in India. The company provides a trading platform to users enabling online trading of commodity derivatives. It operates under the regulatory framework of SEBI of India. MCX is the world’s largest exchange in silver and gold. It was the first exchange to introduce commodity options in India.

MCX platform deals in various commodities across segments including bullion, energy, metals, and Agri commodities. The exchange has an extensive presence in more than 1,040 towns and cities in India with close to 700 members and 2.7 million terminals. The company derives its revenues from transaction fees, admission fees, annual subscription fees, terminal charges, connectivity income, interest income, dividends and gains on sale of investments, and other miscellaneous income. Transaction fees comprise a significant portion (~73%) of the Exchange’s revenue. It is calculated on the basis of the value of commodity futures contracts traded and the volume. MCX operates in a single segment business.

MCX Pros

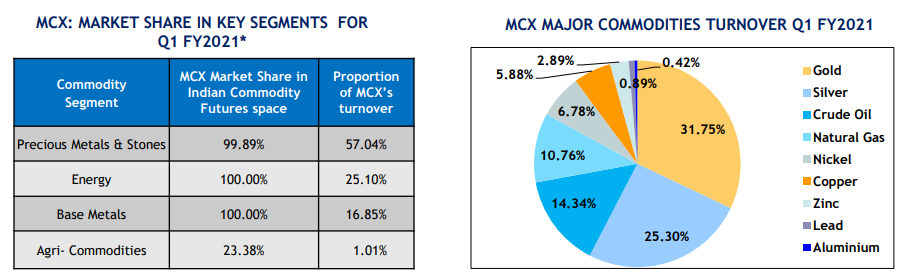

i) Leading Market Share in India - MCX commands a market share of ~96% in the growing Indian market. The Indian commodity market has grown to INR 89 trillion in terms of the value of futures traded from INR 62 trillion in FY 2015. The average daily turnover (single-side) of futures trading on MCX grew by about 26% annually to touch INR 32,424 crore in FY 2019-20. The unique traded client codes also increased from 3.085 lakh in FY 2018-19 to 4.001 lakh in FY 2019-20. Members on MCX typically include producers, end users of the commodity, and manufacturers who constitute a sticky customer base. The demand for commodities is vital as India is a growing country and they are essential in the production of other goods. Commodities are traded through futures contracts, which offer a hedge against future risks and helps you avoid any risk by entering into a long-short position.

ii) Growing Indian Network - MCX has a growing distribution and participation network as bank-sponsored broking entities are allowed to provide services in the commodity derivatives market and institutional investors such as Mutual Funds and Portfolio Managers can participate in exchange-traded commodity derivatives. A large AMC has already launched India’s first mutual fund scheme including exchange-traded commodity derivatives. MCX is thus in a good position to benefit as other AMCs launch schemes containing commodity derivatives as well.

iii) Convenient Online Platform - Commodity trading enables traders to benefit from the price fluctuations in commodities without actually buying the actual commodity. As technology has completely changed the way we lead our lives, MCX has played an instrumental role in providing a platform for online commodity trading. The Exchange started operations in November 2003. It provides a platform for price discovery and risk management and makes it easier for people to trade commodities online. The index also offers its users exposure to the performance of a basket of commodities through the MCX iCOMDEX series of commodity indices. It also offers portfolio diversification and low volatility to the clients. MCX provides warehousing and logistics arrangements with Warehouse Service Providers / Vault Service Providers to its members who are willing to store goods. Advanced trading technologies and greater access to information have further lured investors into online commodity trading.

iv) Wide range of commodities - MCX deals in a wide range of commodities including bullions (gold, silver, platinum), base metals (aluminium, copper, lead, nickel, zinc), energy (crude oil, natural gas), and agricultural commodities (black pepper, cardamom, castor seed, cotton, kapas, etc.). The company has a successful track record of converting the base metal contracts into delivery based contracts. Investors generally resort to hoarding precious metals at times of economical distress like the current one, as they are considered safe havens. MCX also allows spot trading for bullion, natural gas, etc.

v) Growing through Strategic Alliances - MCX converted all MCX Base Metals futures contracts to delivery-based settlement mode from Both-options settlement mode from March 2019 leading to benefit of fair price discovery. It also launched the MCX iCOMDEX commodity index series, comprising a composite index, two sectoral indices, and four single commodity indices in December last year. The exchange is striving to seamlessly integrate with the global commodities ecosystem and has strategic alliances with leading international exchanges viz. CME Group, Dalian Commodity Exchange (DCE), London Metal Exchange (LME), Mozambique Commodities Exchange (BMM), Taiwan Futures Exchange (TAIFEX), and Zhengzhou Commodity Exchange (ZCE).

Challenges

India’s commodity market is facing challenges such as slowdowns and uncertainties in the global economy in recent times, to the economic disruption following the outbreak of the COVID-19 pandemic. Restrictions in trading hours initially, constraints in warehousing and logistics operations, the inability of brokers to operate at full capacity, and demand compression are some of the challenges that the company is facing due to the pandemic. MCX has, however, counteracted and introduced new features to reduce the inconvenience faced by stakeholders.

MCX is the clear leader in the commodity market but faces increased competition from other domestic exchanges such as National Commodity & Derivative Exchange (NCDEX), Indian Commodity Exchange Ltd (ICX), National Multi Commodity Exchange (NMCE), ACE Commodities and Derivatives Exchange (ACE), NSE and BSE. It undertakes research activities for developing new products considering the evolving market needs, policy and regulatory landscape, risk management, and global best practices to stay ahead of the competition. The prices of commodities fluctuate a lot and are highly dependent upon the global and national economic and geopolitical conditions.

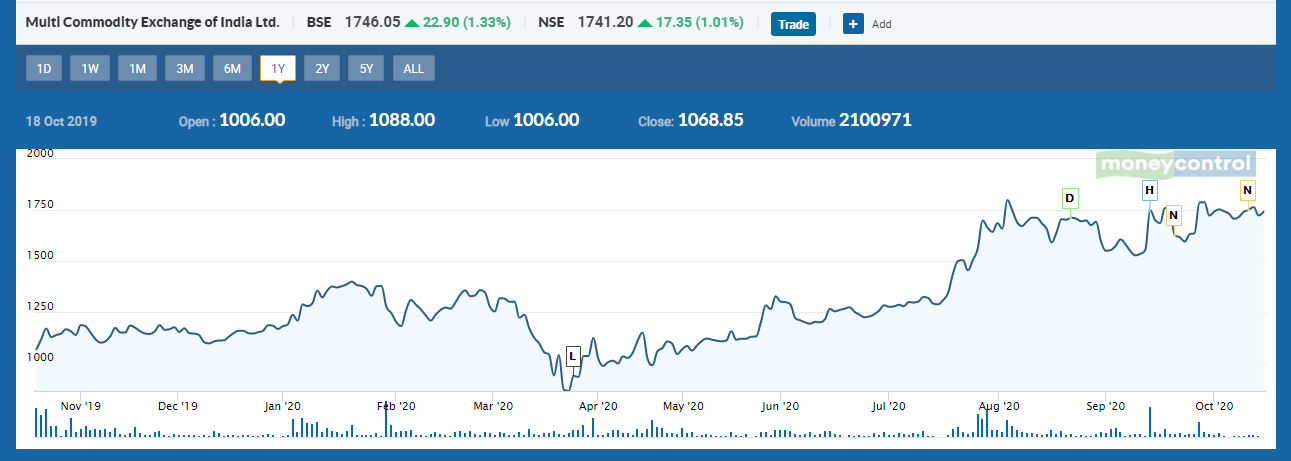

Valuation

MCX is India's first listed exchange and enjoys the first-mover advantage. Its market capitalization value stands at near Rs. 8,880 crores. The company reached its 52 week high of Rs. 1859 in September 2020 and is currently trading just 6% below its 52-week high. The shares have gained by more than 50% in the last six months. The stock’s P/E stands at ~35 while RoE for MCX stands at ~17%. The dividend yield for the stock is 1.72%. MCX is witnessing rising cash flows and strong annual EPS growth with no debt.

Source: Moneycontrol

Source: Moneycontrol

COVID Impact

On account of COVID-19 lockdown and the reduced timing, trading volume for April 2020 and the revenue were adversely impacted. MCX’s recent quarter’s consolidated sales declined by more than 30% QoQ. However, gold and silver prices jumped over the fear of rising COVID cases in India. As such precious metals’ futures trading on MCX has increased during the pandemic period. Given the rising uncertainty in the markets both globally as well as on a national level, investors turn towards hoarding precious metals as they are considered safe havens. MCX is the biggest beneficiary of gold price volatility in the listed space.

Bottom Line

As India becomes one of the fastest growing economies in the world, the demand for commodities has increased notably. As such commodity trading is gaining momentum in the country. The current commodity trade on exchanges is set to grow exponentially due to the introduction of new products and new participants. Commodities provide investors a good option to diversify their portfolios given their non-related returns with conventional classes of assets. The company is well-positioned for long-term volume and profit growth given the increased interest of mutual funds and other alternative investment vehicles.

share your thoughts

Only registered users can comment. Please register to the website.