Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGIN

Britannia Industries (NSE:BRITANNIA) is one of the five largest FMCG companies in India. It is the leading biscuits and bakery products company in the country founded in 1892. It is now a part of the Wadia Group. The company has a collection of strong and well-known brands. Its Good Day is the most trusted food brand in the country while Marie Gold and Bourbon are the sixth and the eleventh most trusted food brands, respectively.

Britannia’s product portfolio includes biscuits, bread, cakes, rusk, and dairy products including cheese, beverages, milk and yogurt. Its products are available all over the country and it also has a large international presence in the Middle East, Nepal, North America, Europe, Africa, South-east Asia. The primary business segment of the company is Foods.

Britannia Pros

i) Most Trusted Brand in India - Britannia is among the most trusted food brands in India. Few of its popular brands like Good Day, Tiger, NutriChoice, Milk Bikis, and Marie Gold are household names in India. The company has a century-old rich legacy with annual revenues of more than Rs. 9000 crores. Britannia has customized its product portfolio to focus on healthier products as consumers become more health-conscious. It removed over 8500 tonnes of trans fats from its products and over 50% of the company’s portfolio now comprises healthy micro-nutrients. The company further targets to reduce 5% each in sugar and sodium in its products by 2022. Britannia generated ~2% of revenue from new categories and launched seven new products in the last year. Customers trust the Britannia brand for its relentless focus on quality and freshness. Britannia Cheese is the largest growth driver in Dairy.

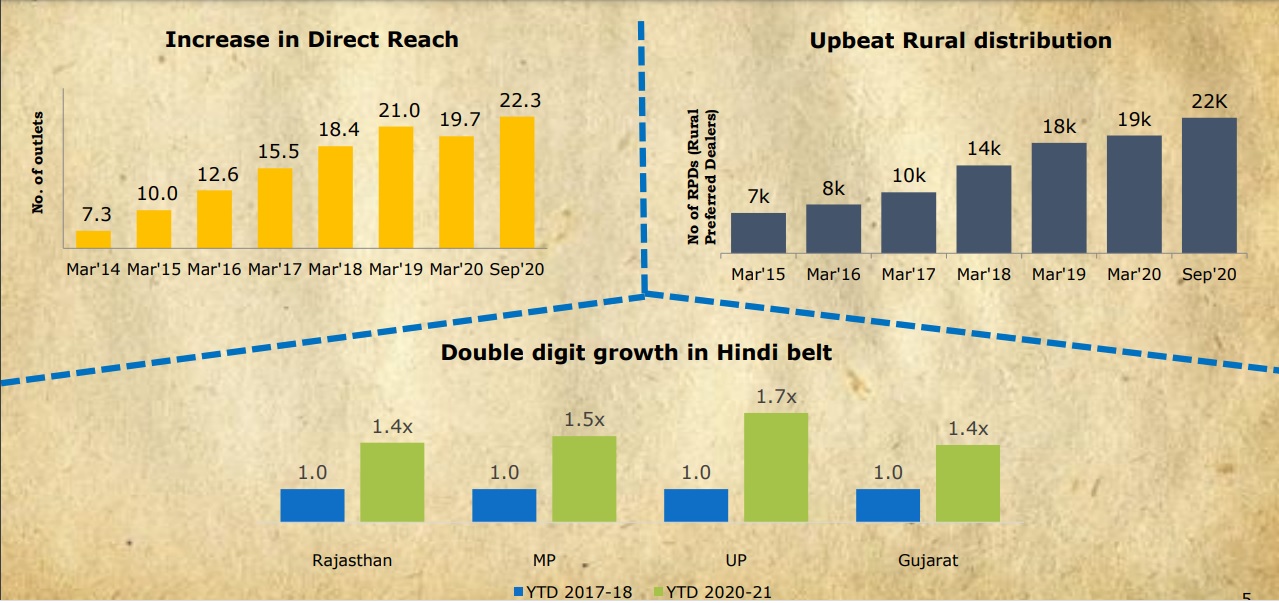

ii) Growing Through Obstacles - Britannia launched several innovative delivery solutions for overcoming the lockdown obstacles. It partnered with Dunzo to deliver its products right at the customers’ doorsteps and also launched the Britannia store locator, a WhatsApp based store locator tool. The company has a large distribution network and reaches over 50% of Indian homes through its five million retail outlets. Britannia dairy products directly reach 100,000 outlets. Its bread business operates through 13 factories and four franchisees selling close to 1 million loaves daily across more than 100 cities and towns in India. Britannia has grown its footprint in the rural and Hindi heartlands of India over the years. It has close to 22,000 rural distributors and direct reach of 22.2 lakhs. UP is the strongest market for the company.

iii) Large Market Share in the growing Indian market - Britannia Bread is the largest brand in the organized bread market. Its bread business processes over one lac tons in volume and Rs.450 crores in value annually. Britannia stands a good chance to gain from laws like Make in India, Farm Bill revolution, and eased labor law in India. Given its pocket friendly and tasty products, easy availability, and an increasing population in India, Britannia continues to gain additional market share. The company also has a growing international presence and plans to expand in Africa and Southeast Asia in the coming years. It set up a manufacturing facility in Nepal and operations have already begun.

iv) Profitable Adjacent Businesses complementing Its Core Business - Britannia’s core business comprises of biscuits, cakes, rusks, bread, and dairy. The company benefits from increased consumption of its core products across India. Britannia’s adjacent business that comprises cream wafers, croissants, snacks, etc. complement its core businesses. Britannia is the first branded player with a large national presence to enter the cream wafers business. It enjoys a first-mover advantage in many other key categories as well. The company is targeting to capture the market share in these categories by building the base business and launching new-to-market formats. Given the company’s relentless focus on customer taste and satisfaction and strong brand recall, customers are more open to trying its new products.

Covid Impact

FMCG growth was about 5% to 7% in lockdown as there was panic buying on staples. Britannia gained during the lockdown period as essentials benefited and traditional Kirana store sales improved. But its topline and bottom line declined by 7%-10% due to the shutdowns. It is now witnessing pent up demand for non-essentials. A decline in out of home consumption impacted its drinks portfolio while cheese and rusk witnessed good growth. The cake business has not been growing very aggressively as modern trade and on transit clusters like railways, etc., were affected during the lockdown period. As conditions improved, Britannia benefited from broader consumer trends as biscuits were the most consumed cheap product at homes. It was also the first one to resume manufacturing operations among its peers.

Challenges

As Britannia operates in the FMCG sector, it will remain highly dependent upon the prices of commodities and raw materials used in food production. Any inflation in commodity prices will have a direct impact on the cost of the finished products and hence on the company’s profitability as it leads to an increase in input costs. Britannia is one of the five largest FMCG companies in India. The other four being Hindustan Unilever Ltd., ITC Ltd., Nestle India, and Godrej Consumer Products Ltd.

Opportunities

Britannia is targeting an investment of over Rs 700 crore to open five new manufacturing units in the next two-and-a-half years to meet the growing demand in India. The company focuses on growing by reducing costs and improving efficiencies. It is well-positioned to gain from its adjacent businesses as well. Given its long-standing customer relations, large footprint, extensive R&D, and innovative products, Britannia is well-placed to cater to changing consumer patterns in a post-COVID world. The company’s market share continues to grow especially across the Hindi belt.

Valuation

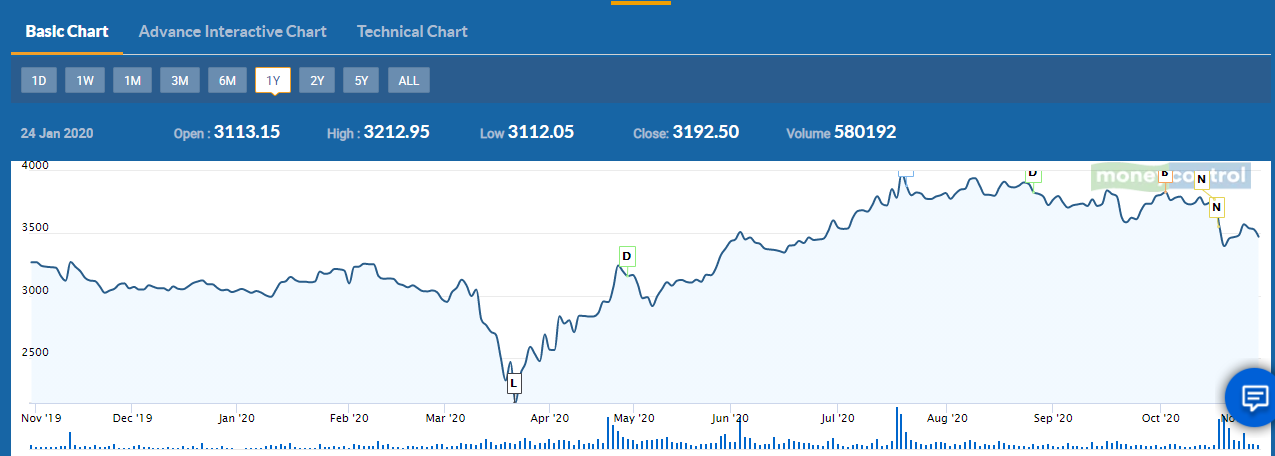

Britannia has a market capitalization value of more than Rs. 83,600 crores and its shares are currently trading at ~48 times its earnings. The shares are 13% below their 52-week high price. It also pays regular dividends and sports a modest dividend yield of ~1%. Dividends have grown at a rate of 37% CAGR since 2016. The company paid an interim dividend of Rs.35 per share of Re.1 each for FY 2019-20. Total dividends paid during the last year were Rs.841.6 crores. Britannia made a bonus issue of 1:1 recently. The company is a part of the Nifty 50 league. Its revenues and net profits have grown at 8% and 18% CAGR, respectively in the last five years.

Source: Money Control

Bottom Line

2019-20 was a challenging year for Britannia due to the economic slowdown in the country impacting consumer spending. Britannia is witnessing stabilized sales as conditions begin to normalize. However, there is going to be a little turmoil from an economic standpoint till the virus completely wipes out. Still, Britannia is witnessing healthy double-digit growth in international markets and single-digit growth in the Middle East. It is anticipating 5%-7% demand growth in the coming quarters driven by festivities and increasing out-of-home consumption. Britannia is a good way to play the secular growth of consumerism in India.

share your thoughts

Only registered users can comment. Please register to the website.