Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINSBI Life Insurance is one of the most trusted and leading life insurance providers in India. It is is a joint venture between State Bank of India and BNP Paribas Cardif S.A. and was incorporated in the year 2000. The company offers individual and group products which include savings and protection plans to address the insurance needs of diverse customer segments. Its products are available in the life, pension, annuity, and health segments.

SBI Life is one of the top private players in terms of AUM. The company provides a wide range of insurance and pension products to millions of families across India. It has covered more than 45 lakhs lives, issued over 5.9 lakhs policies, and sold over 1.75 lacs individual protection policies. The company has been focusing strongly on protection and annuity plans. Its insurance ecosystem is huge, reaching out to customers even in the remotest corners of the country through an unparalleled network of offices and bancassurance and agency channels. A strong brand recall, unparalleled distribution network, robust digital platforms, and rich management expertise are SBI Life’s strong competitive advantages.

SBI Life Insurance Pros.

i) Diversified Products and Customers - SBI offers a host of insurance plans and products like online plans, protection plans, wealth creation, retirement, and child plans. It serves individuals as well as group customers through Protection, Pension, Savings, and Health solutions. SBI Life’s product basket includes 28 individual products and six group products. The company is known for providing a hassle-free claim settlement experience to its customers. Over the years, SBI Life has developed deeper relationships with customers through quality underwriting and satisfaction levels. It covered about 8.9 million lives in FY20.

ii) Large Footprint through a vast distribution network - SBI Life has an extensive presence across the country through its 947 offices, a large individual agent network of about 154,158 agents, 58 corporate agents, a bancassurance network of 15 partners, more than 28,000 partner branches, 108 brokers and other insurance marketing firms. It has a diversified distribution network comprising of a strong bancassurance channel, agency channel, and others comprising of corporate agents, brokers, micro agents, common service centers, insurance marketing firms, web aggregators, and direct business. NBP channel mix for H1 FY 2021 is bancassurance channel 49%, agency channel 13%, and other channels 38%. SBI Life also has a strong online presence with 98% of individual applications now submitted digitally. A diversified network of traditional and alternative channels enabled the company to maintain business continuity during Covid-19.

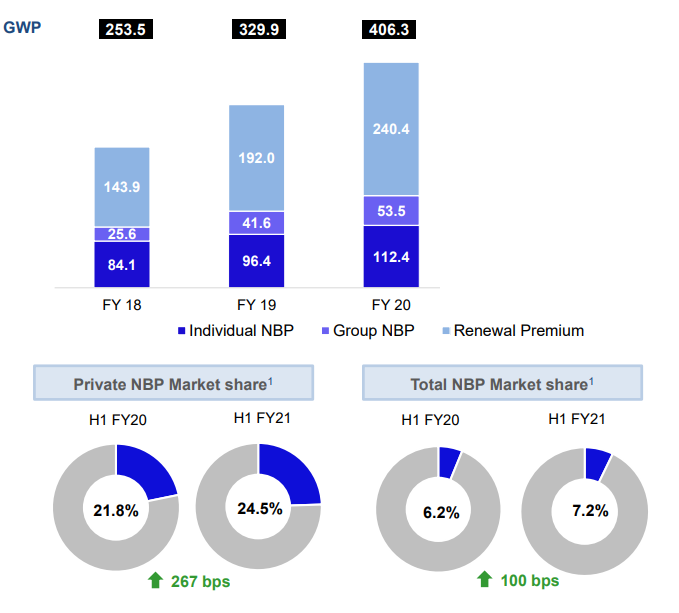

iii) Improving Financial Metrics - SBI Life has been gaining momentum in new business collections as well as strong growth in renewal collections. The company’s share has increased across both private and total NBP markets post initial lockdown. It continues to make progress across all key customer segments. SBI Life’s AUM continues to grow and registered a growth of 20% in H1 FY20. Its AUM comprises government securities (38% of the overall mix), equity (24%), debentures and bonds (30%), and the balance of 8% in fixed deposits, money market, instruments, and others.

iv) The SBI parentage and growing India story - State Bank of India is the largest commercial bank in terms of assets, deposits, branches, and customers. It is one of the oldest banks in the country and has an impeccable reputation for trust and services. It is difficult for newcomers to build the same level of trust and customer base that SBI Life has amassed over the years. Moreover, SBI is a well-known financial organization in India which is the fifth-largest economy in the world in terms of GDP. The country is one of the highest young population nations with a median age of 28 years. Growing trends of urbanization, rising affluence, and an increase in per-capita income act as strong tailwinds for the Indian insurance industry. It is estimated that 40% of the total population in India will be urbanized by 2030. Therefore, India has a high potential for future growth.

COVID-19 Impact

SBI Life has witnessed a growth of 29% YoY in renewal premium and 20% CGAR YoY in gross written premium. There was an increased awareness amongst customers resulting in an improvement in premium. New business premium also grew at a rate of 14% CAGR. The company is taking a prudent approach toward sustainable recovery to counter the post-pandemic slump. SBL Life has a sound track record of recovery from periods of disruption given its solid distribution network.

Future Opportunities

As life expectancy increases, the demand for pension based products will also increase. SBI Life continues to invest in emerging technologies to further drive efficiency and provide innovative solutions to customers at attractive prices. The current environment has also brought to light the importance to have insurance covers.

Challenges

Though the insurance business is a highly capital-intensive business, it is highly competitive in India with both well-established private and public players. SBI Life ranks among the top three companies in the private sector in terms of new business premium. HDFC Life and ICICI Prudential are the other two large competitors. Fears of job loss and salary cuts might dissuade people from investing in insurance products.

Valuation

SBI Life Insurance Co. has a market capitalization value of more than Rs. 90,000 crores and trades at a PE of 53x while the industry PE stands at 68x. Shares of SBI Life are currently trading near the Rs. 855 mark just 16% below its 52-week high price. Though shares have not gained much in the last year, it has returned more than 20% in the last five years. SBI Life is almost debt free, however, its promoter holding has reduced by 23% in the last three years. The company did not declare any interim dividend during the year due to restrictions imposed by the regulators in light of COVID-19.

SBI Life maintains a healthy solvency ratio of 2.45. It has been maintaining high levels of cost efficiencies which have led to growing profitability. The company had an AUM of ~Rs.1,860 billion as of September 30, 2020.

Bottom Line

SBI Life is well-positioned to maintain steady growth and long term consistent returns. It occupies a leadership position in the tenth largest life insurance market worldwide which is also highly underpenetrated. Over the last two decades, SBI Life has strengthened its leadership position in the private life insurance space. Its focus on digital transformation has reduced the need for face-to-face interactions and further supported new investments from potential clients. The life insurance industry in India has been on a rise but given the country’s low insurance penetration, there exists a vast untapped opportunity.

share your thoughts

Only registered users can comment. Please register to the website.