Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGINCadila Healthcare (NSE:CADILAHC) or Zydus Cadila is a leading pharmaceutical company. It is a fully integrated, global healthcare provider. The company possesses in-depth domain expertise in the field of healthcare and has strong capabilities across the spectrum of the pharmaceutical value chain. It ranks fourth in the Indian pharmaceutical industry. The group has manufacturing sites and research facilities spread across five states of Gujarat, Maharashtra, Goa, Himachal Pradesh, and Sikkim in India and in the US and Brazil. The company also has a large presence across four continents of the US, Europe, Latin America, and South Africa and a growing presence in 25 other emerging markets worldwide. It has more than 36 manufacturing plants worldwide including India, Brazil, and the USA.

The company has a rich experience of over 65 years. Over the years, the company has been at the forefront, contributing to therapeutics, vaccines, and diagnostics. It commands a leading position in therapy areas like oncology and rheumatology. Zydus derives 45% of its revenues from US formulations, followed by India formulations (27%), wellness (13%), animal health (4%), EMB formulations (6%), and balance from API, Europe formulations, and alliances.

Zydus Cadila Pros

i) A diversified portfolio of healthcare, wellness, and animal products

Zydus Cadila’s business in India comprises the Human health formulations business, Consumer wellness business, and Animal health. During the year, the company restructured the product portfolio of its 100% subsidiary Zydus Healthcare Ltd, which contributes to over 80% of the India Human Health Formulations business into mass and specialty. Zydus Wellness has consolidated its position in the Wellness segment with the integration of Heinz Portfolio. The company has registered a good performance in its wellness business growing its EBITDA at 21% CAGR in the last two decades. Zydus Wellness commands the leading market share position in five out of seven categories that it operates. It is also a key player in the evolving biosimilars business and its portfolio targets 21 products worth ~$ 65 billion sales in 2019. The company has more than 18 years of experience in biosimilars development.

ii) Integrated Manufacturing and growing sales

As one of the key players amongst the pharmaceutical manufacturing companies, the group has manufacturing capabilities across the entire pharmaceutical value chain from formulations, APIs, vaccines, biosimilars, complex products to animal health and wellness products. The company has grown its revenues at 18% CAGR in the last two decades. Zydus Cadila also posted strong results in the latest quarter. The company reported a 41% increase in sales due to robust sales in all segments.

iii) Extensive research and innovative technologies

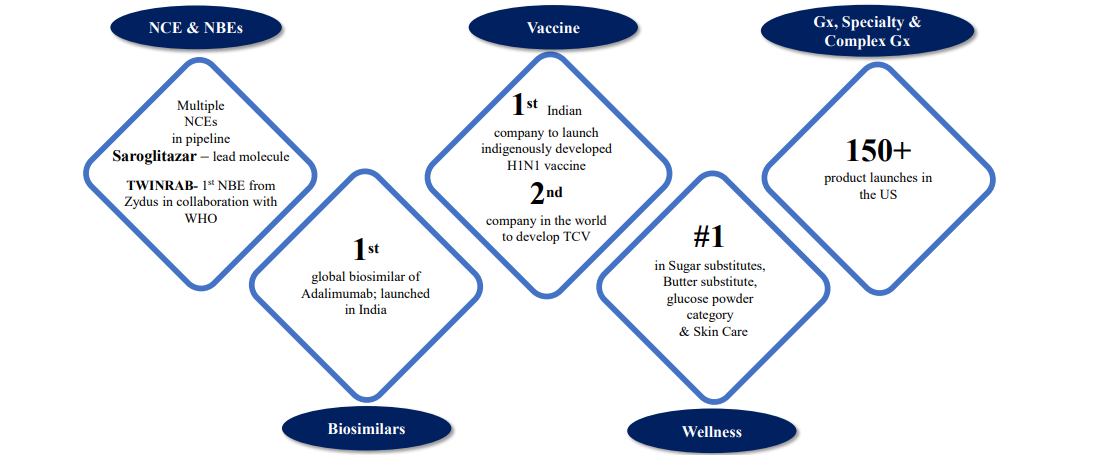

Zydus has extensive research facilities across 19 sites. The company has been exploring different medicines across NCEs, vaccines, biosimilars, and niche technologies. Zydus filed 10 additional ANDAs with the USFDA taking the cumulative number of filings to 410 and received 9 new product approvals. The company has been spending more than 7%-8% of its annual revenues on R&D activities over the last five years. Zydus has been a pioneer in launching new products to meet the unmet needs in India.

Source: Investor Presentation

iv) Impressive Pipeline

Zydus Cadila is one of the largest vaccine makers in India with more than 20 years of experience. The company received approvals to start Phase III clinical trials of Pegylated Interferon Alpha-2b in India and the approval to start Phase III clinical trials of its vaccine ZyCoV-D against COVID-19. The trials for the vaccine are also underway. It has more than 10 products in NCEs/ NBEs in the pipeline. Zydus is developing a portfolio of complex generic injectable products representing $28 billion in market opportunities.

v) Growing Indian and US business

Zydus Cadila has been growing its US generics business over the years as is evident from its improving market share in the US market. Its Indian business has also been a constant growth driver. India is the largest provider of generic drugs globally and caters to more than 50% of global demand for vaccines and over 40% of generic demand of the US market. Growing and aging population in key markets, improving purchasing power, and access to quality healthcare and pharmaceuticals are driving the growth of the global pharmaceuticals industry.

The company is also developing a specialty product portfolio in select therapy areas such as pain management, specialty neurology, dermatology, rare diseases, specialty oncology, gastroenterology, and liver diseases to expand the specialty business in the US.

Valuation

Shares of Cadila Healthcare are currently trading near the Rs. 468 mark nearly doubling from the last year’s price level. The company has decent investment fundamentals with an ROE of 14%. The stock is currently trading at 23x its earnings which is cheaper than the industry PE of ~31x and at 4.10x its book value. Cadila Healthcare’s market capitalization value is more than Rs. 47,900 crores. The company has maintained a healthy dividend payout of more than 20%. The Indian Pharma index outperformed the market dring 2010-2015, however, the growth has reduced in recent years. The next spurt of growth can only be generated through innovation.

The company has reduced its debt over the years from Rs.29 billion to Rs. 38 billion in the none months of FY 2021. It has delivered 20% CAGR total shareholder returns and 18% CAGR EBITDA growth over the last 15 years.

Challenges

Zydus Cadila has delivered a poor sales growth of 10.50% over the past five years. The company’s market share in India is a modest 4% since 2014.

Most Indian pharma companies are subject to uncertain market conditions, stringent regulatory norms, and pricing pressure. The company is highly susceptible to unfavorable regulatory changes and price-control measures by the Indian government.

Future Opportunities

Zydus Cadila’s strategy is to focus on the biosimilar market in emerging markets and India. The company successfully grew its sales in Brazil, Mexico, and South Africa in the last year. The company is also looking at novel drugs for future growth. Zydus Cadila’s huge portfolio of novel drugs and biosimilars has the potential to sustain double-digit sales growth. It should also benefit from animal healthcare demand as it is the second-largest animal healthcare company in the country. But currently, the biggest opportunity for the company is to gain from its potential COVID-19 vaccine, ZyCoV-D which is progressing well in the phase III trials. The company is also focusing on integrating channel partners, supply chain, and procurement to improve revenue and cost synergies.

Bottom Line

Zydus’s diversified revenue stream, growing presence in the international market, particularly the US, and a strong foothold in the branded generics market in India position it well for future growth. The company’s merger with Heinz has further strengthened its wellness business expanding its rural outreach and resulting in revenue synergies and cost savings. Zydus’s U.S., wellness, and domestic sales are expected to grow at a sustainable rate over the medium term.

share your thoughts

Only registered users can comment. Please register to the website.