Focus on Rural Areas and Increased Construction Activities Should Support Pidilite Industries

Summary

- Growth in 3Q stemmed from alternate trade channels like e-commerce, modern trade and Pidilite ki Duniya. E-commerce sales saw 3x growth, with modern trade sales and PKD sales growing by 1.2x and 1.3x, respectively.

- Resurgence of construction activities should act as a principal growth enabler.

- In FY21, consumer & bazaar business should continue to be highest contributor to revenues.

About Pidilite Industries Limited

Pidilite is a consumer centric company, with commitment to quality and innovation. From adhesives, sealants, waterproofing solutions and construction chemicals to arts & crafts, industrial resins, polymers and more, it has a diverse product portfolio. Its brands are trusted household and industrial names, and the company is a market leader in adhesives. JVs and subsidiaries of Pidilite Industries ensure that it continues to remain a leading player in most categories in over 100 countries. The company understands importance of having global perspectives in today’s shrinking world and because of this, it has enhanced its international presence through several ventures across globe.

Growth Enablers of Pidilite Industries

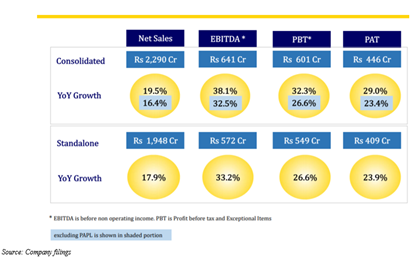

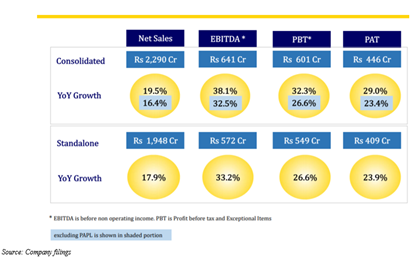

- Strong 3Q Results Exhibit Confidence: 3Q saw broad-based growth across all businesses and geographies. Consumer and Bazaar businesses saw its volumes grow in excess of twenty percent and B2B segment was able to see reasonable growth. Benefits of input costs and lower discretionary spends lent some support to profitability. Focus will be on achieving volume growth by investing in brands, sales and distribution and consumer relevant innovation. Continued demand in rural areas and strong recovery in urban including metros resulted in strong growth across all verticals. Resurgence in industrial activity led to healthy volume growth in Business-to-Business segment too. Financially, net sales have seen a growth of 20% to INR2,290 crores over same quarter last year. Net sales for 9M ended were INR5,021 crores and declined 12% over same period last year. EBITDA before non-operating income was INR641 crores, exhibiting a growth of 38% over same quarter last year due to lower input cost and A&SP spends.

- Acquisition of 100% Stake: On November 3, 2020, Pidilite made an acquisition of 100% stake in Huntsman Advanced Materials Solutions Private Limited. HAMSPL has now been renamed to Pidilite Adhesives Private Limited. This company sells adhesives, sealants and other products under well-known brands like Araldite, Araldite Karpenter and Araseal in Indian sub-continent region. Araldite is a market leader in epoxy adhesives and should add to strong portfolio of Pidilite’s adhesive and sealant brands. PAPL has nation-wide distribution network and strong presence in retail trade.

- Resurgence in Economic Activity Should Support Growth: Economic activity is impacted by a number of factors, like social distancing, subdued demand and labour shortage. Resurgence in economic activity has now begun, which should help revive demand conditions. Overall, there is still uncertainty about downside risks to domestic growth as continued slowdown in construction industry and economic growth can impact sales growth. Major international subsidiaries are located in Bangladesh, Sri Lanka, USA, Brazil, Thailand, Egypt and Dubai. Several initiatives are being taken in Bangladesh and Sri Lanka to increase sales and market share. US subsidiary plans to maintain focus on retail and e-commerce.

- Performance of Domestic and Overseas Subsidiaries: Pidilite Industries has 20 overseas subsidiaries and one JV. Subsidiaries having overseas presence have seen strong performance, reporting sound constant currency revenue growth and strong growth in earnings. In 3Q, Asia region saw growth of 10.7% on year-over-year basis, with Americas and Middle East and Africa regions ending this quarter after seeing growth of 47.7% and 6.6%, respectively. These figures are in constant currency terms and are like for like actual reported numbers not accounting for translations and other consolidation impacts. The company has 15 domestic subsidiaries and 2 partnership firms. Domestic subsidiaries in C&B segment have seen healthy growth, with subsidiaries in B2B segment exhibiting signs of recovery in latter part of 3Q.

- Targeting Rural Areas: The company has been increasing its reach in rural areas, having population of less than 50K. Alternate trade channels is another area from where Pidilite Industries has seen some demand. These channels include e-commerce, modern trade and Pidilite ki duniya and all of these channels have augmented its 3Q growth. The company should see its revenues and margins getting benefitted from resurgence in construction activities as economic activities are getting back on track. Increasing rural penetration should act as another growth enabler. Construction activities are likely to seek support from “housing for all” and “smart city mission”. 100% FDI has been permitted under automatic route across several infrastructure sectors. According to DPIIT, FDIs in construction development sector and construction activities were USD25.78 billion and USD17.22 billion, respectively, between April 2000 and September 2020. Significant investment in infrastructure was seen as overall PE/VC investment reached an all-time high of USD14.5 billion in 2019. Largest deal was made by Abu Dhabi investment authority, public sector pension investment board and national investment and infrastructure fund as they have done investment worth USD 1.1 billion in GVK Airport Holdings Ltd.

- Consumer & Bazaar Business Should Contribute Highest: In FY20, Pidilite Industries saw revenue from operations of INR6,332.59 crores. Out of this, consumer & bazaar business made up ~78.8%, while B2B business saw its contribution of ~19.96%. In FY21, the company’s consumer & bazaar business is expected to remain top contributor to revenues, with segment getting support from strong growth in economic activities and resurgence in construction activities.

- Outlook on Market Conditions: Pidilite Industries Limited exhibited that strong retail consumer demand was visible, which should continue given a fall in COVID-19 cases. Recovery in urban (Metros and Tier 2 cities) due to revival in economy has lent some support to rural demand. Market conditions have improved and this improvement should continue as there has been a resurgence in industrial and manufacturing activities and real estate and construction activities have been resumed. Growth is likely to be continued for general trade as alternate trade channels are on rise.

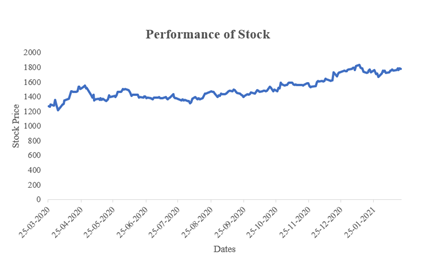

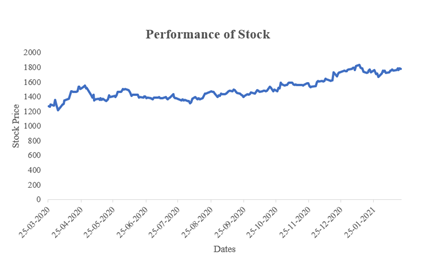

- Strong Performance Post March 2020: Stock of Pidilite Industries has seen a strong run up from March 2020 to February 2021. To be precise, the company’s stock saw a close of INR1,271.1 on March 25, 2020 and on February 19, 2021 it saw a close of INR1,781.35, exhibiting an increase of ~40.1%. This phenomenal growth stemmed from favourable market dynamics, revival in economic activities and improvement in demand conditions. Economic recovery has supported this significant rise in share price. The company’s conference call highlighted that strong retail demand, dealer expansion and revival in industrial and manufacturing activities and real estate should be able to stem rise in share price.

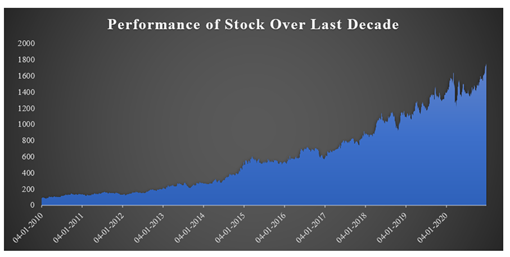

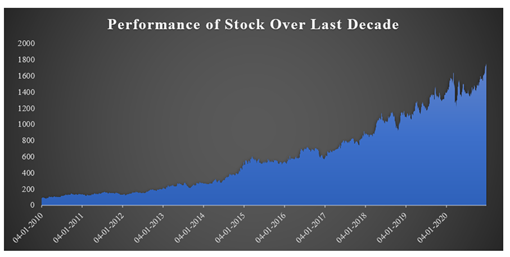

Multi-bagger Returns Over Past Decade

Selecting a stock having potential to generate multi-bagger returns is a tedious task. Once it is done, goal of wealth creation can easily be met. Obviously, there are several factors one should consider when one is hunting for a stock capable of delivering multi-bagger returns. Few measures people use include revenue growth, profit growth, variety of products, quality of management, efficiency in managing capital, etc. Some people give preference to size of addressable market and ways the company is planning to capture or increase its market share and in how much time.

From list of stocks delivered multi-bagger returns, one stock has turned many heads. Its Pidilite Industries Limited. Over past decade, the company has grown its core numbers. Pidilite Industries has compounded its sales and other income at ~11% from FY10-11 to FY19-20. It has compounded its operating profit at ~14.2% and PAT at ~15.4%. These reasonable and sound growth rates achieved by Pidilite Industries exhibits that it has capitalized on market opportunities. Given its market size, the company should be able to satisfy its stakeholders and continue this growth. Over past decade, the company’s stock has delivered a return of ~1856%. Simply put, an investor who would have invested INR1,00,000 in this company’s stock on January 4, 2010 would have got ~INR19,56,005.79 on December 30, 2020. It goes without saying that these exceptional returns promote investments in equity over other asset classes.

A View on Valuations

Pidilite Industries Limited is having a total market capitalisation of ~INR88,97,704.40 lakhs and free float market capitalisation of ~INR26,55,943.12 lakhs. The company’s stock saw a significant increase after easing of lockdown restrictions. When market conditions were favourable and supportive, Pidilite Industries has capitalised on that opportunity. Indian economy gives large opportunity to the company to market differentiated products. Stock currently trades at ~80.7x of FY20 EPS.

The company’s 2Q saw improvement in demand conditions each month. Consumer and Bazaar businesses saw growth in volumes because of strong growth in rural and semi urban areas. B2B businesses and metros have seen some improvement as compared to 1Q.

Exclusivity:

This article is exclusive to investoguru.

Stock Disclosures:

The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Author Disclosures:

This Article represents the Author's own personal views. The Author did not receive any compensation and do not have any business relationship with any of the companies mentioned in the Article.

share your thoughts

Only registered users can comment. Please register to the website.