Va Tech Wabag Ltd: Healthy Order Book and Market Opportunities Should Drive Growth

Summary

- Significant fall in debt and favourable sectoral dynamics should lend some support to stock price of Va Tech Wabag Ltd.

- The company is having strong credit metrics and adequate liquidity profile, enabling it to deal with sectoral challenges.

- With focus on emerging markets, the company plans to fill a huge infrastructural gap.

Va Tech Wabag Ltd

WABAG is counted amongst world's leading companies in water treatment space. Water saga of WABAG spans over 90 years, making it an industry leader in field of total water management. Having presence in 4 continents, WABAG is a pure-play water technology multinational, offering wide range of solutions. These solutions are focused on conservation, optimisation, recycling and reuse of resources, directed at addressing water challenges. Key competences lie in turnkey execution and operation of water and wastewater treatment plants for both municipal and industrial sectors. WABAG carries successful track record of executing over 6000 municipal and industrial projects globally. With R&D centers located in India, Austria and Switzerland, it’s a technology focused company, owning over 90 patents. Along with India, the company has marked its presence in regions such as South East Asia, Middle East, Africa, Europe and Latin America. Global clientele includes mix of municipal and industrial clients. These clients have believed in competency, both technical and commercial.

Growth Enablers of Va Tech Wabag Ltd

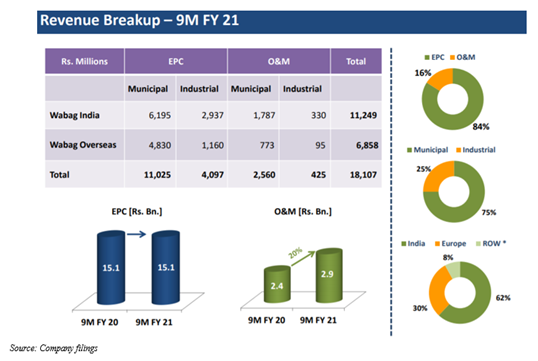

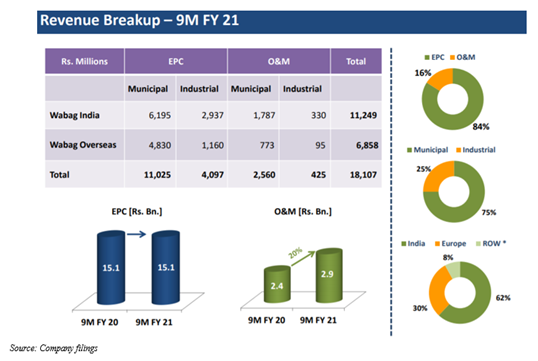

- Significant Debt Reduction Should Support Future Growth: Over 9M ended Dec 2020, Va Tech Wabag Ltd saw order intake of over INR9.7 billion, with consolidated revenue of INR18.4 billion and consolidated EBITDA of INR1.4 billion. The company infused INR120 Crores through equity fund raise from marquee investors. Last capital raise was of INR120 Cr in IPO 2010 and the company grew 3x in last 10 years. Since Mar 2020, the company saw gross debt reduction of 26% and net debt reduction of 31%. On consolidated basis, higher revenue was a result of improvement in execution pace as there were COVID-19 relaxations across geographies. Focus on debt reduction led to fall in net interest cost. Higher order book resulted in increase in bank charges. 3Q performance exhibits improvement in execution as most sites were normally operating. Despite challenging period, the company added ~INR1,500 crores worth of orders principally from MEA region to its order book.

FY20 was indeed a busy one for the company as key projects were picking up pace, allowing the company to achieve good results and cash flows. This good performance was accompanied by certain set of challenges as Covid-19 pandemic impacted entire world, causing great sense of unease. Government responded to this crisis by significant intervention. Businesses and organisations rapidly started adjusting to varying needs of people, customers, and suppliers. Debt management and healthy order book should help Va Tech Wabag Ltd in dealing with sectoral challenges.

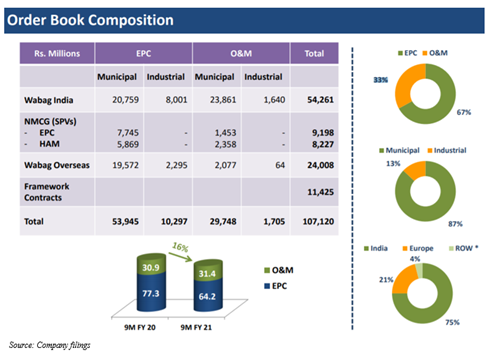

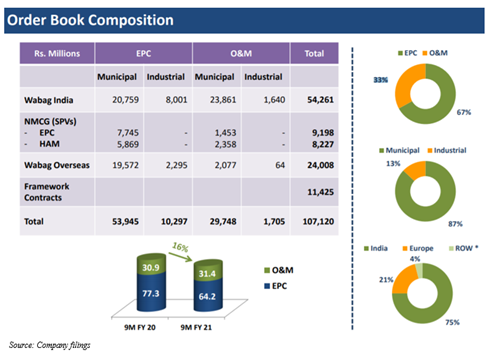

- Healthy Order Book: Including framework contracts, Va Tech Wabag Ltd has healthy order book of over INR11,000 crore as on Mar 31, 2020 due to significant order intake of INR4,350 crore. Total consolidated income, constituting revenue from operations, for FY20 was INR2,557 crore against INR2,781 crore in previous year. As at Dec 2020, the company’s total order book was of INR107,120 million, with Wabag India making up INR54,261 million, Wabag Overseas making up INR24,008 million and framework contracts making up INR11,425 million. Out of total order book composition, Engineering Procurement and Construction formed 67% and Operation and Maintenance formed 33%.

- Industry Dynamics: Water is an indispensable element for human survival and economic growth. With world population at 7 billion, 1 billion+ people lack access to clean drinking water and sanitation. Need for clean, accessible drinking water, along with demands of growing world population and higher use by developing countries will burden natural resources. Global average for water stress stands at 11% but, still ~31 countries experience this in corridor of 25%-70%, while 22 countries fall above 70%. Global water treatment industry has seen a sea change over past decade. This is principally due to rising awareness about water scarcity, innovations seen in water treatment technologies and investments by Government bodies and private sectors in this segment. Demand of freshwater stems from growing requirement for alternative water sources, increasing focus on water quality and public health, higher requirement of treating industrial wastewater and strict regulations by Government. Development of improved wastewater treatment methods should support global wastewater treatment market. This stands true for membrane-based water treatment methods. Strategies the company is putting in place have mitigated some challenges. The company should be able to exploit opportunities arising in a growing economy. Plans are there to utilise strengths in addressing water challenges by giving innovative solutions to customers.

- Water Trends in Asia-Pacific Region: Asia-Pacific region constitutes diverse range of countries with varied climates. Pacific islands are principally dependent on limited groundwater supplies and these supplies are susceptible to pollution and saline intervention, making islands face distinctive challenges of water scarcity. In monsoon and irrigation dependent countries such as India, China, Bangladesh and Pakistan, irrigated agriculture makes consumption of over 70% of annual average water resource availability. Rising population, growth in urbanisation and poor water management is resulting in depletion of freshwater in Southeast Asia. China, India, Japan, Bangladesh and Vietnam are countries having biggest opportunities for wastewater treatment. Improvement of water governance and capacity building, enhancing water services delivery, and encouraging integrated management of water resources are principles focused on by various institutions during time of adoption of different policies. In India, water is actually a scarce resource. With only ~0.5% of world’s water being fresh, country can access to only 4% of world’s freshwater resources. This is a relatively low percentile considering population size of over 1.3 billion people. Remaining percentage is unevenly distributed, with accessible supplies severely contaminated. Ever-growing population, rapid industrialisation, growing agriculture and rapid lifestyle changes results in shooting up of water demand and stress. In India, water stress and rapid depletion of fresh groundwater is resulting in growth of water solutions industry. Manufacturing and hospitality sectors are now focusing on reducing their water usage. These sectors form part of water-intensive industry. These sectors are investing and taking measures focused on improved waste treatment systems so that target of water conservation can be achieved. The company has prepared itself to utilise strengths in addressing water challenges by providing innovative solutions.

- Focus on Emerging Markets: Since the company focuses on emerging markets, it finds that there is a huge infrastructural gap. This gap should be addressed. Deepening water crisis of India can be resolved with help of desalination technology, used to convert seawater into potable water. Government should work in tandem with private sector. Low-cost desalination plants should be set up in states seeing acute water shortage. Support of government is mandatory to plug-in leakages in pipelines.

- International and Domestic Businesses Performed Better: In FY20, the company saw a balanced performance. Healthy improvement in underlying operating margin at 9.6% and strong operative cash flow of INR245 crore supported good profitability. International and domestic businesses of the company saw better performance. Consolidated order intake for FY20 was at INR4,350 crore. From overseas operations, net orders were INR896 crore, accounting for 21% of total orders secured during FY20. Global trends of rapid urbanisation, and growth in commercial segment should lend support to the company, considering its size, scale and capability. The company is likely to see strong growth because of strong order book. Focus is also on emerging markets for increasing business profitability.

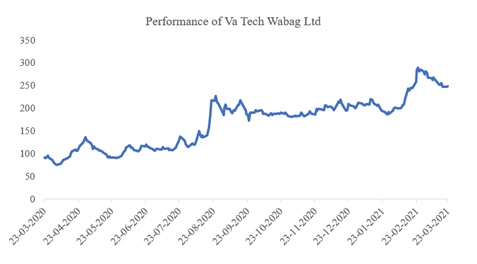

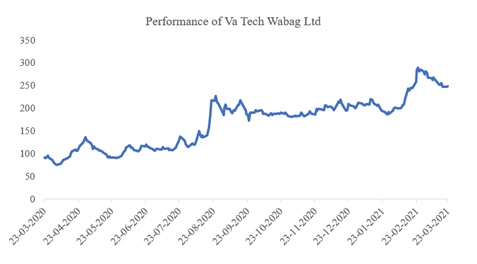

Lower Valuations Exhibit Going Long on Va Tech Wabag Ltd

Since FY10-FY11 to FY20, Va Tech Wabag Ltd has compounded its order book at ~13.98% and revenue at ~8.35%. The company has a total market cap of ~INR1,47,391.31 lakhs and free float market cap of ~INR97,216.70 lakhs. This company has turned many heads in recent past. Renowned Indian investor Rakesh Jhunjhunwala has added this stock to his portfolio. Investors in this stock have seen strong returns since this addition. With rise in markets, net worth of Rakesh Jhunjhunwala has also increased. While this is a stock which is not known to investors, it has delivered multi-bagger returns over past one year. Between March 23, 2020- March 23, 2021, stock has increased by ~170.9%. This effectively means that if an investor would have invested INR1,00,000 on March 23, 2020, it would have become INR2,70,906.11 on March 23, 2021.

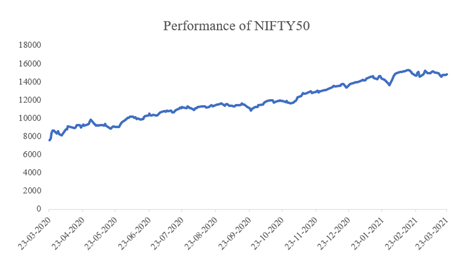

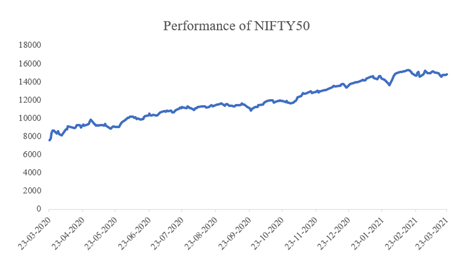

Impact of COVID-19 was seen on NIFTY50, dropping it to significant lows. When situation normalised and government started to intervene, improvement was seen in NIFTY50. While Va Tech Wabag Ltd saw a return of ~170.9% over Mar 23, 2020-Mar 23, 2021, NIFTY50 delivered only ~94.7%.

Stock price of Va Tech Wabag Ltd trades at ~22.05x of FY20 EPS in comparison to sectoral average of ~28.65x. This exhibits that the company’s stock trades at a discount, favouring long position.

Exclusivity:

This article is exclusive to investoguru.

Stock Disclosures:

The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Author Disclosures:

This Article represents the Author's own personal views. The Author did not receive any compensation and do not have any business relationship with any of the companies mentioned in the Article.

share your thoughts

Only registered users can comment. Please register to the website.