Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGIN

NESTLE India (NSE:NESTLEIND) is the second-largest FMCG company in India. With a history dating back to 1912, Nestle India has come a long way starting out as a Condensed Milk company. The company was authorized by the Government to develop the milk economy in India with a single factory in Moga, Punjab.

Today, Nestle offers a wide range of products across beverages, breakfast cereals, chocolates and confectionary, dairy, nutrition, foods, etc. The company has a huge brand recall in India. Nestle India has a presence across India with eight manufacturing facilities and four branch offices. The company is rapidly expanding its geographic footprint. Nestle derives 95% of its sales domestically and 5% from international markets. Nestle has over 90% market share in baby food, 60%+ in instant pasta/ Maggi, and 70%+ in condensed milk.

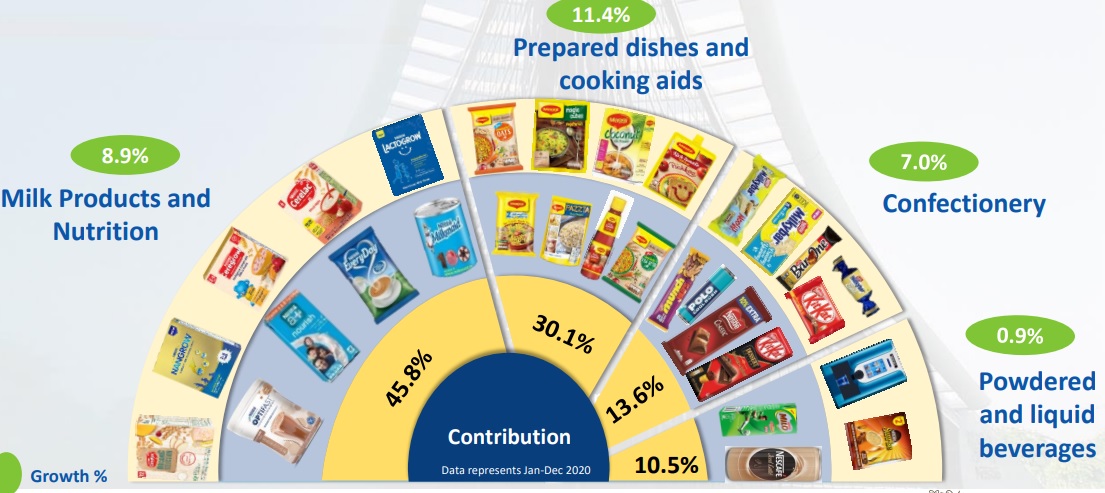

Nestle’s Revenue Mix

The company’s business activity falls within a single operating segment, Food. Nestle generates 46% of its 2020 revenue from milk products and nutrition (dairy products and weaning foods), 29% from prepared dishes and cooking aids (the Maggi range), 11% from powdered and liquid beverages (instant coffee, iced tea, and other beverage vending mixes), and 13% from confectionery (including Kit Kat and Munch). It has products catering to all age groups in its portfolio. The company has a repertoire of high-margin products such as Nestle Resource Opti (protein health drink), Nestle Pre Nan (for premature babies), Nan Grow, etc. on one hand, and Cerelac, Lactogen, and Ceregrow for the price-conscious on the other.

Source: Nestle Presentation

Nestle Pros

i) Iconic National Brands - The company has popular brands such as NESCAFE, MAGGI, MILKYBAR, KIT KAT, BAR-ONE, MILKMAID, and NESTEA under its portfolio. It also expanded its portfolio with everyday consumption brands like NESTLE Milk, NESTLE SLIM Milk, NESTLE Dahi, and NESTLE Jeera Raita. Nestle enjoys a leadership position in seven out of eight categories in most years.

ii) Innovation and R&D - Nestle has a sound history of innovation in taste, nutrition, health, and wellness. Over the years, the company has developed a better understanding of the changing lifestyles of India and adapts to the evolving consumer needs through healthier product offerings. It invented a new way of making chocolate without added sugar. The company’s extensive centralized Research and Development facilities give it a distinct advantage. Nestle’s R&D in India is part of NESTLE S.A.’s global R&D network and supports all markets worldwide.

iii) Benefit from the growing FMCG sector in India - Nestle provides livelihood to about one million people including farmers, suppliers of packaging materials, services, and other goods. About 99% of its products sold in India are also Made in India. The company is known for offering consumers a wide variety of high-quality, safe food products at affordable prices. Nestle is well-positioned to tap the growing consumption opportunity in India. It is expected that India will add ~140 million middle-class and ~20 million high-income households by 2030. The company has been rapidly expanding its geographic footprint in India and targets to reach ~120,000 villages by the end of 2024. Nestle is well-positioned to gain from the growing FMCG sector in the country. It has established a strong presence across all urban towns (~7,900+) in the last five years. Nestle has a strong distribution network, and the company is focused on expanding its penetration in rural areas.

iv) Strong Brand Recall and Customer Trust - Nestle is trusted for its quality, tasty, nutritional, and safe products and has a strong customer base. It will be difficult for customers to shift and adapt to a new ‘Maggi’ or ‘Cerelac’. These names have become synonymous with the food category they belong to. Nestle is an undisputed market leader in baby food. Some Nestle products like Maggi having specific local flavors have become popular among NRIs, attracting increased export sales. Better nutrition is the need of the hour today and Nestle, given its impressive innovation and renovation streak and R&D expertise has been aggressively launching new and improved products over the years. It introduced over 80 new products in the last five years and has over 40 new innovation projects in the pipeline. New products have contributed over 4% to the company’s annual sales in each of the last two years.

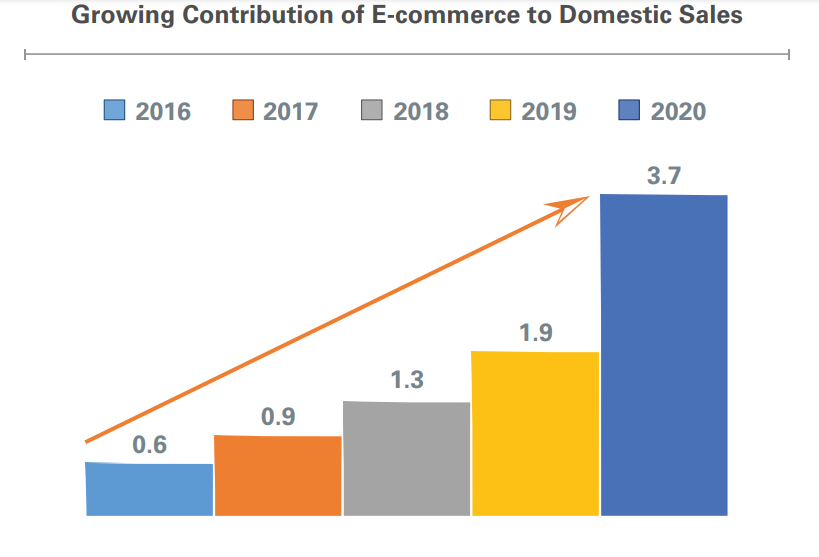

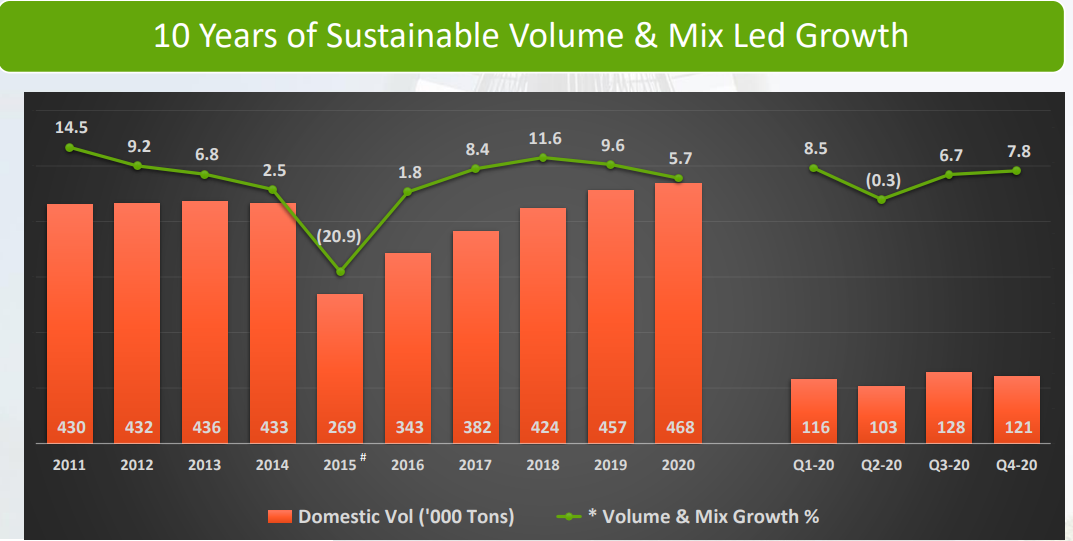

v) E-Commerce to contribute towards growing sales - Nestle’s domestic sales have increased by almost 45% in the 2016-2020 period while its export sales have remained constant during this time. The company witnessed strong domestic sales growth driven by volume and mix. Its e-commerce sales grew by 111% in FY2020 due to a rise in in-home consumption and e-commerce continues to account for a major portion of domestic sales. Nestle’s exports registered a 4.8% volume growth, driven by categories such as Prepared Dishes and Cooking Aids, Milk Products, and Nutrition in 2020.

Source: Annual Report 2020

COVID-19 Impact

Being a consumer-defensive company, the demand for Nestle’s items of daily consumption was least impacted by the pandemic-induced economic slowdown. Nearly two-thirds of its key products posted double-digit growth during the last year on the back of increasing in-home consumption. However, the COVID-19 pandemic also led to changes in food consumption habits. There has been a shift towards easy-to-prepare meals, food and beverage options, cooking aids, and recipe solutions.

Challenges

Being a leading FMCG company in India, Nestle is susceptible to commodity price headwinds, however, the company has been successfully navigating those commodity headwinds.

HUL, Colgate-Palmolive, ITC, Parle Agro, Britannia, Marico, P&G are other leading FMCG companies in India.

Future Opportunities

Nestle has projected to spend Rs. 26 billion to strengthen its existing manufacturing capacities, as well as towards the construction of its new factory in Sanand, Gujarat over the next three to four years. The company continues to explore new markets for categories such as Prepared Dishes and Cooking Aids, Chocolates, and Confectionery in the Middle East. Nestle is projecting that the Indian packaged food market will double in the next 5-10 years to $70 billion on the back of economic growth, demographics, and growing e-commerce.

Valuation

Nestle has a history of sustainable performance supported by its strong cost and efficient management. Nestle has a market capitalization value of more than Rs. 162,700 crores and its shares are currently trading at ~78 times its earnings almost similar to HUL near 75x. The company’s market capitalization value has increased from just Rs.50 billion to more than Rs.1,770 billion in the last two decades. It is the second-largest FMCG company in India, by market capitalization value, right after Hindustan Unilever. Nestle’s shares are currently ~10% below their 52-week high price. Nestle has consistently increased dividend per share over the years registering a CAGR of 35% over the last four years. Its dividend payout has more than doubled during the period 2016-2020. The company also declared a special interim dividend in 2019.

Nestle sports ROE and ROCE of 100%+ and a dividend payout ratio of 90%+. The company’s profits have grown at 19% CAGR in the last three and five-year periods.

Source: Investor Presentation

Bottom Line

The FMCG market in India is set to expand exponentially and rural India presents the biggest market potential for the industry. The company should continue to grow driven by a strong innovation and renovation pipeline, penetration-led growth, and R&D expertise. Nestle stands to benefit from steady growth in its star products, consistent performance, steady margins, and opportunities to launch products from its parent portfolio. Despite the challenges in the last year, Nestle retained strong leadership in 85% of its portfolio.

share your thoughts

Only registered users can comment. Please register to the website.