Colourful Future Awaits for Asahi Songwon Colors Limited

Summary

- Despite serving leading clients, Asahi Songwon Colors Ltd. sees 80%+ of business as repeat business.

- New markets and entry into Azo pigments should act as principal growth accelerators.

- In last 15 years, competitive landscape in phthalocyanine pigments saw a change, with India becoming significant force in markets by taking share away from China.

Overview of Asahi Songwon Colors Limited

Asahi Songwon Colors Ltd. manufactures pigments. These pigments are colourants, adding colour to ink, paints, plastics, textiles, rubber, etc. It is a leading player in Indian Pigment industry, intending to become a leading manufacturer of pigments. The company manufactures CPC Beta Blue and Blue Crude and exports substantial production to leading MNCs due to quality of its products. This company constantly endures networks with global giants and serves its clientele from USA, Japan, Korea, Italy and South Africa and India for last 25 years. Dynamic strategies of the company focus on improving productivity, capacity enhancement, management of costs, customer satisfaction, addition of new products, environment and safety management and working capital management. Target is to become a market leader in pigment industry in process of adding new products in basket.

Growth Enablers of Asahi Songwon Colors Limited

- Cost Reduction Supported in 3Q21: Asahi Songwon Colors Limited saw profit after tax of INR852.69 lakhs in 3Q21 on revenues of INR7,249.71 lakhs. It saw revenue growth of 24% and profit growth of 142.90%. The company undertook cost reduction and it lent some support to the company. Its total income was INR90.48 crore at end of 4Q21 in comparison to INR71.76 crore in 4Q20, while EBITDA was INR13.53 crore for 4Q21 against INR10.93 crore in 4Q20. In FY21, the company’s revenues remained largely stable. The company’s investments in Azo segment of ~INR82 crore should start playing out.

- New Markets Should Open Up New Avenues: The company plans to make sure value creation through addition of new products, diversifying in newer segments, enhancing share of value-added products and managing costs and processes. Plans are there to introduce new products and make an entry into new markets based on potential. The company targets product quality and competitive pricing to make presence in new markets and it plans to have geography-specific strategies. The company’s client base and strong customer relationships should continue to lend support. Repeat business and revenues should be able to stem from relationships with customers.

- A Silver Lining: Operations of Asahi Songwon Colors Ltd. were affected because of lockdown by government of India to curb spread of COVID-19. Because of significant challenges, it is important to go beyond financials to multiple efforts that the company undertook in FY20. The company entered into Azo pigments segment with help of joint venture with UK’s leading colour manufacturer, Tennants Textile Colours. Azo pigments are non-toxic and better alternative to toxic organic and inorganic pigments. While China continues to be a market leader in these pigments, significant global demand and lesser number of operational players in India means that there is an attractive opportunity to manufacture domestically. The company plans to be a globally leading pigment manufacturer and its entry into Azo Pigments segments should enable the company to accelerate ambition, while it focuses on building a solid foundation for business growth and revenue diversification. While TTC brings in technology know-how in red, yellow and orange pigments, Asahi Songwon Colors Limited brings cost competitiveness, knowledge of domestic market and strong business relations to table.

- Entry into Azo Pigments Should Supplement Growth: The company’s entry in Azo pigments space should give it a perfect launch pad to improve its presence as leading global supplier of pigments. Since China is largest global supplier, backlash against China as a result of COVID-19 and significant high demand and few operational players in India gives the company a great opportunity. Target is to increase capacity so that it can compete with major players. Domestic manufacturing should ensure lesser production cost and customers look to shift from China. With TTC’s technology and the company’s manufacturing efficiencies, joint venture should be able to capture new market and cross-sell to the company’s existing client base. In this joint venture, Asahi Songwon Colors Ltd. holds 51% stake and TTC 49% and it was commissioned on Dec 14, 2020. This was four months before it was originally targeted.

- Increased Utilisation of Installed Capacities Should Lend Support: Asahi Songwon Colors Ltd. plans to continue with efforts to increase utilisation of installed capacities, enabling the company to achieve improvement in operational results. The company plans to prioritise quality of products. Focus will be on cost reductions, operating efficiencies and diligent management of cash in value-creating opportunities. Now that Azo pigments is added in its product basket, the company should be able to address any sort of future challenges. Massive new opportunities are expected to arise and the company should be able to capitalize on those opportunities.

- Growth Should Stem from Sectoral Dynamics: The company sees brighter and better future, despite pandemic sticking around. Things should return to normal over medium- to-long-term. With companies looking to shift operations from China, it represents a huge opportunity for Indian companies. Advantage of availability of raw material, lesser labour cost and large base of end-user industries should make India a lucrative destination for chemical manufacturing. Help from government to set-up strong infrastructure should provide much-needed support. The company holds strong reputation in global chemical industry for its quality, operational excellence, timely delivery and cost competitiveness. In FY20, when the company faced competitive and challenging industry scenario, its focus was on improving fundamentals to make sure that it is ready to deliver when market revives. It has adopted globally accepted best practices and made investment in automation technologies, while enhancing its operational efficiency. This led to cost optimisation.

Conclusion

Asahi Songwon Colors Ltd. has long track record in pigment industry. Growth is likely to stem from leverage & debt coverage indicators that are reasonable. The company has seen moderate diversification in customer base as there were some additions of new customers during past couple years. Since it is an export-oriented company, its export sales made up 66% of the company’s total operating income during FY20. With domestic market sales contributing 34% to total operating income during FY20, the company now has increased its focus on domestic market.

The company still supplies pigments to some of world’s largest colorant companies and it has strong and long-standing business relationship with key clients. It has added some new customers in both domestic and export markets over past couple years, leading to some moderation in client concentration risk. Total operating income of the company fell 3.4% because of fall of 4% in sales realization of products and remained at INR283.6 crore during FY20. Ability of the company to supply products to customers on time despite COVID-19 and benefit from lesser cost of crude-based raw materials lent some support to the company in 1H21. Capital structure of the company was sound as it saw an improvement in overall gearing on account of declining working capital borrowings. During FY20, debt coverage indicators also improved and remained healthy.

Entering into Azo pigments segment through joint venture should result in diversifying revenue stream and accelerate growth. The company improved and strengthened relationships with customers, suppliers and employees and it saw improvement in operational efficiencies and gaining of market share. Cash flows were managed and this should stem growth.

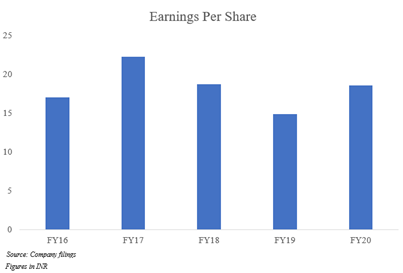

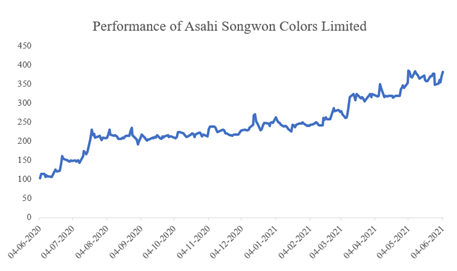

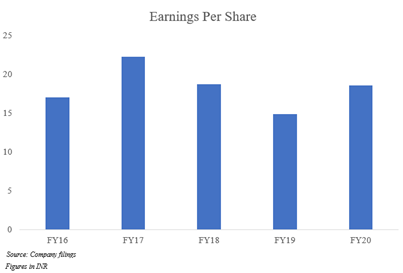

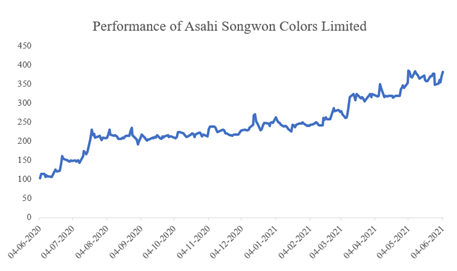

The company has compounded its revenue at ~6.09% over FY16-FY20 and it has a total market cap of ~INR43,779.23 lakhs and free float market cap of ~INR11,542.08 lakhs. Stock price of the company saw a significant rise of ~269.91% between Jun 4, 2020- Jun 4, 2021. Increase in stock price should be supported by consolidation of global pigment industry and strong technical capabilities.

New plant at Dahej should benefit the company on account of skilled labour, strong common infrastructure facilities and raw material availability in proximity which leads to logistics cost savings. A 51:49 Asahi:TTC joint venture was formed under name of Asahi Tennants Color Private Limited and joint venture should be able to capture significant market opportunity. The company leverages its expertise, experience and technical capabilities in developing products catering to diverse needs of clients. Revenue contribution from exports was 60% in FY21 and highest contribution was made by United States of America, followed by Korea, Japan and Germany.

Exclusivity:

This article is exclusive to investoguru.

Stock Disclosures:

The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Author Disclosures:

This Article represents the Author's own personal views. The Author did not receive any compensation and do not have any business relationship with any of the companies mentioned in the Article.

share your thoughts

Only registered users can comment. Please register to the website.