New Emerging Trends and Unique Business Model Should Support Mahindra Holidays & Resorts India Ltd.

Summary

- Unique business model and wide variety of marquee properties across India and abroad should continue to act as principal growth enablers.

- Mahindra Holidays & Resorts India Ltd. is focused on leisure travel and family experiences and the company should benefit from pent-up demand for leisure travel.

- From now onwards, domestic leisure travel should lead to improved performance of HCR.

About Mahindra Holidays & Resorts India Ltd.

Started in 1996, Mahindra Holidays & Resorts India Ltd. is a part of leisure and hospitality sector of Mahindra Group. It offers quality family holidays principally through vacation ownership memberships. The company brings values like reliability, trust and customer satisfaction. Flagship brand ‘Club Mahindra’ has 250,000+ members, eligible for holidaying at 100+ resorts in India and abroad. The company forms part of Mahindra Group. Over last decade, Mahindra Holidays & Resorts India Ltd. has now established as a market leader in family holiday business. All of the company’s resorts are geared to address a variety of holiday needs and experiences across areas of operation.

Growth Enablers of Mahindra Holidays & Resorts India Ltd.

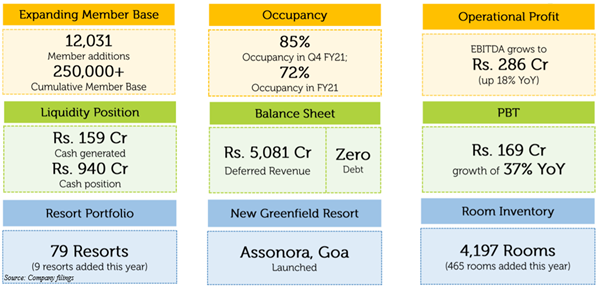

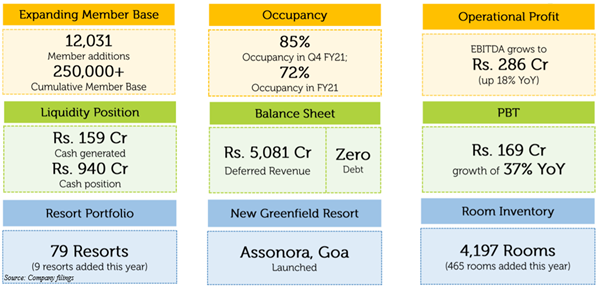

- Laying Base for Future Growth: In 4Q21, the company saw member additions at 4,789, exhibiting a rise of 32% in comparison to previous year. Member additions saw growth every quarter to reach a total of 12,031 members during FY21. Cumulative member base is now 2,54,431. The company saw high resort occupancies at 85% in 4Q21 and this was close to pre-pandemic levels. For FY21, there were occupancies of 72%. The company’s milestone of 4,000+ rooms was achieved, resulted from addition of 465 rooms during FY21. This took the company’s total inventory to 4,197 rooms. Mahindra Holidays & Resorts India Ltd. saw a rise in share of member acquisition through digital and referral routes to 55% in FY21. Despite the company facing Covid-19 challenges, it saw strong performance in 4Q21. This can be seen from its occupancy, resort income, member additions etc. The company is considered as a viable investment option as its business model is unique and different from traditional hospitality sector. Pent-up demand for leisure family experiences should now be unlocking which should help the company emerge stronger. Operations at Holiday Club Resorts saw a brunt of Covid-19 related local restrictions. With pace of vaccinations, the company’s business is likely to improve. Growth is likely to be supplemented by onset of summer season which should result in growth of domestic leisure travel. On a related note, Holiday Club Resorts is the company’s European subsidiary. Consolidated turnover of the company reached INR1,847.3 Cr. for FY21 in comparison to INR2,431.1 Cr for FY20, with consolidated EBITDA reaching INR348.7 Cr. for FY21 against INR427.9 Cr for FY20.

- A Peek into Past: During FY20, the company saw creditable performance. This was despite unstable macroeconomic environment and unfavourable consumer sentiments for discretionary purchases. All this was visible in first three quarters of FY20. Outbreak of COVID-19 pandemic resulted in slowdown of economic activity in Mar 2020. If history is any indication, March is a peak month for the company. Due to COVID-19, business operations of the company were impacted. Impact was seen particularly in new member additions and resort operations. During FY20, the company saw addition of 15,697 new members to vacation ownership business. This took total membership to 2.58+ lakhs at FY20 end. Addition in members was seen because of continued success of pull-based digital and referral leads and reaching to prospects through engagement with help of innovative platforms, alliances and corporate partnerships. In near term, domestic travel should stem healthy growth as members opt for holidays within scope of drivable distances. This is something the company should be able to serve, with 60 resorts across India. Large apartment sizes and concept of villas in several resorts ensures safety which should increase attractiveness of its membership for customers. The company performed well in FY20 and was because of unique business model and predictability of revenues in form of various annuities such as a deferred revenue of INR5,500+ crores which is to be recognised over membership and 250,000+ member base that makes contribution to revenues with help of holiday spends and annual subscription.

- Capitalising on New Emerging Trends: Mahindra Holidays & Resorts India Ltd. should be able to capture emerging trends in Indian hospitality industry. After several months of lockdown, revenge/reward tourism was seen principally due to pent-up demand for leisure travel. After easing of lockdown restrictions, bounce back in occupancies was seen in 3Q21 and 4Q21. Now, the company expects this kind of similar rebound in occupancies once normalisation occurs. When situation normalises, travel and tourism players can be seen competing for and capturing wallet share. Mahindra Holidays & Resorts India Ltd. has large and committed base of 250,000+ members and its wide range of resorts across India should help the company in post pandemic era.

- Competitive Advantages: People with 45+ age group are frequent travellers and they have higher propensity to spend and travel. Large proportion of the company’s member base is of similar age group and they are eligible for getting vaccinations early. Recovery should be led by these people. The company should be able to capitalise on significant potential for further growth of vacation ownership industry in India. This is principally because market penetration is very low. On comparison of Indian vacation ownership industry with that of USA in terms of share in hospitality sector, scope for growth in India is estimated to be at least 5x that of its current size. Similar environment can be seen if one considers other surrogates like ownership and sale of cars. This is exhibited in quicker growth in domestic tourism and this trend is likely to accelerate in post-COVID scenario. It is reasonable to expect that occupancies at resorts should see some improvement through loyal member base, once travel restrictions get eased off. New member additions should be dependent on consumer sentiment which can see some improvement after restrictions are lifted and life gets back to normal. Solid experience ecosystem of the company, with 100+ resort options and membership privileges give the company a distinct competitive edge. This competitive edge is either in terms of suitable holiday options or amenities of resort in a post-COVID world or ability to drive business, once sentiment gets improved.

Conclusion

Mahindra Holidays & Resorts India Ltd. has recommenced its resorts operations, though in a staggered manner. With majority of its resorts now being operational, the company should be able to see a quick revival. Holiday Club Resorts Oy, Finland has recommenced its operations of SPA hotels. Mahindra Holidays continues to own 100% of HCR Oy through stepdown subsidiaries. The company seems confident on performance of HCR and it was able to drastically reduce its debt on HCR books from Euro 51.7 million as on Sept 2014 to Euro 26.0 million as on Mar 2021. The company plans to capitalise on industry dynamics as it should be able to cater to domestic leisure travel demand. New and emerging consumer trends should be able to support the company and there persists a large and attractive addressable market for vacation ownership in India. Penetration of vacation ownership in India is at mere ~2% in comparison with ~11% in US.

The company added 9 resorts during FY20 and resorts count now stands at 70. Including 33 additional resorts through its HCR, members have access to 100+ resorts spanning across India, Asia, Europe and USA.

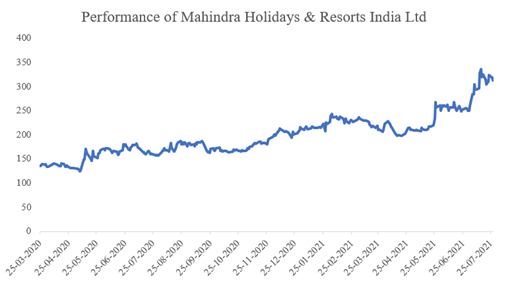

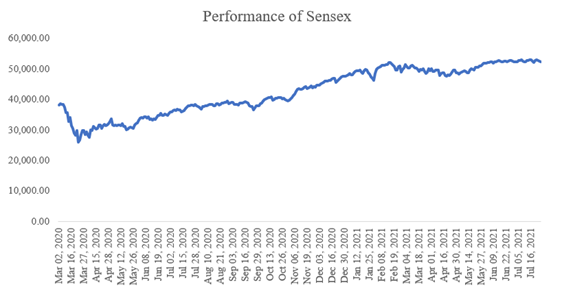

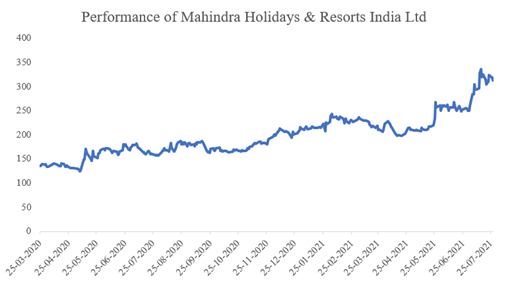

Stock price of Mahindra Holidays & Resorts India Ltd. saw multi-bagger returns even during turbulent times. Its stock has increased ~130.13% between Mar 25, 2020- Jul 27, 2021.

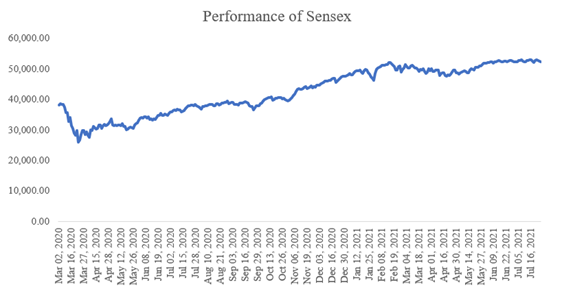

In comparison, Sensex has delivered only ~84.26% return. As and when Indian economy started opening, its stock price saw some improvement. Tourism sector was most impacted sector due to pandemic. If an investor would have invested INR1,00,000 on Mar 25, 2020, it would have become INR2,30,132.46 on Jul 27, 2021.

Despite seeing extreme adverse situation caused by second wave, the company delivered strong performance during 1Q22. PAT went up by 13.1% year-over-year. Recovery was seen in member additions as second wave started to recede from mid-June onwards. Leisure travel should see some improvement from now onwards. Local restrictions impacted operations at the company’s European subsidiary, Holiday Club Resorts. There were closures of spa hotels. The company expects domestic leisure travel to improve which should lead to better performance of HCR. In 1Q22, resort operational occupancy was 51%, with digital and referral contributing 63% of member acquisition.

Exclusivity:

This article is exclusive to investoguru.

Stock Disclosures:

The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Author Disclosures:

This Article represents the Author's own personal views. The Author did not receive any compensation and do not have any business relationship with any of the companies mentioned in the Article.

share your thoughts

Only registered users can comment. Please register to the website.