Create a free account or login to access more of investoguru.com

Create a free account or login to access more of investoguru.com

REGISTER NOW OR LOGIN

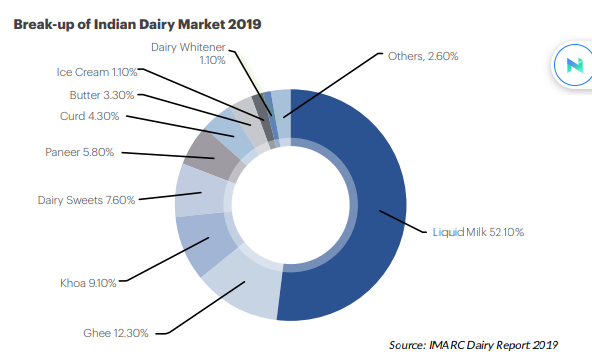

With a very ancient tradition of cattle raising for domestic consumption of milk, India is the largest producer and consumer of Milk in the world. Contributing to over 22% of global milk production, the country’s milk production reached about 193 Million tonnes in FY20, consuming almost all this quantity. In spite of topping the global table in overall production and consumption, the per capita consumption of milk in India is quite low, thereby offering significant headroom for demand growth over a sustained period of time. Indian dairy industry, which has traditionally been highly fragmented and hence being dominated by the unorganised segment, has been making a slow yet steady shift towards a larger play by the organised segment in recent times. This shift augurs well for the industry as organised players bring in fair play, economy of scale, adoption of modern technology and product innovations along with market development for high end premium products. Consequently, the share of organised segment is estimated to grow to 35% by 2024 from 30.3% in 2020

Company Overview:

With nearly three decades of presence in the Indian dairy segment, Parag Milk Foods Ltd. (the Company/PMFL) is one of India’s leading dairy FMCG companies with a diverse portfolio in 15+ consumer centric product categories. The Company is adept with the best global source of expertise and scientific knowledge in support of the development and promotion of quality cow’s milk and milk products, to offer consumers nutrition, health and wellbeing. Though started small with producing only fresh milk and skimmed milk powder (SMP), the Company has completely transformed itself with product offerings covering over 170 SKUs of a wide range of value-added products such as cheese, ghee, paneer, curd, dairy based beverages, whey protein etc.

Market Leadership and innovation

It is the 2nd Largest Player in Cheese in India with a 35% Market Share.

It is a leader in the Cow Ghee category with its brand ‘Gowardhan’ Ghee

It is India’s First Company to launch a truly ‘Made-in-India’ B2C Whey protein powder under Brand ‘Avvatar’ in 2017.

It is the only company to manufacture Fresh Paneer with a 75 Day Shelf Life.

Its cheese plant has the largest production capacity in India, with a raw cheese production capacity of 40 MT per day.

Product Portfolio

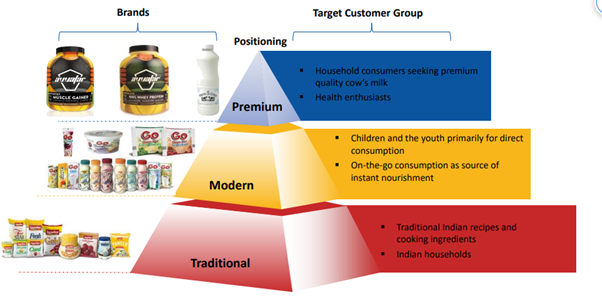

Its product portfolio is categorized under following brands:

Gowardhan brand- Everyday dairy products, like Ghee, Milk, etc.

GO brand- UHT milk, an array of processed and natural cheese products, etc. [1]

Pride of Cows brand (premium packaged milk)- Introduced the concept of farm-to-home milk. The milk is untouched by human hands and the whole process is completely automated. This service is currently available across Mumbai, Pune, Surat, and Delhi.

Avvatar brand- It is in the sports nutrition segment for health enthusiasts. It launched 100% vegetarian home-grown whey proteins in 2017.

Revenue

Revenue Distribution is Consumer Products (67.4%), Fresh Milk(18.6%), Skimmed Milk Powder (12.8%), Other Revenue (1.2%).

The company has seen an increase in its value-added products segment from 64% in FY2017 to 77% in Q3FY2021.

Whey Protein

Whey protein is sold in both the sports nutrition segment and consumer nutrition segment. The market for whey protein in 2019 was ` 6.6 Billion. While almost 100% of whey protein products in the sports segment are imported, the health and nutrition market is dominated by a few large MNCs. The total Whey powder market is expected to grow at 22.1% CAGR during 2019-2024 to reach ` 18 Billion by 2024.

Manufacturing Capabilities

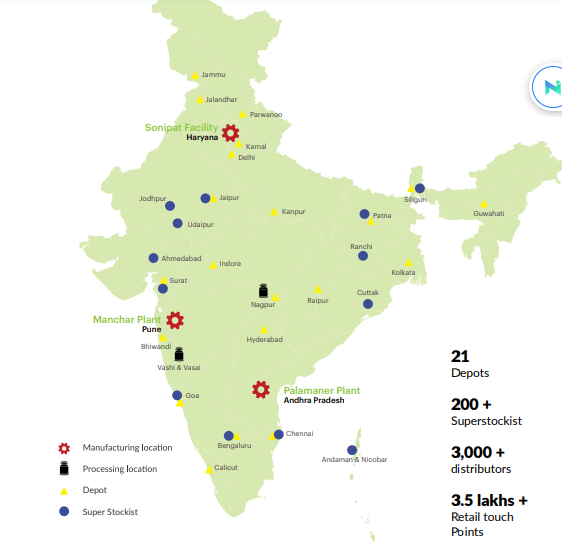

The Company’s manufacturing facilities are strategically located in the richest milk belts at Manchar in Maharashtra, Palamaner in Andhra Pradesh, and Sonipat in Haryana. UHT Technology (heating it above 135 °C that kills many bacterial endospores) is of European technology, fully automated, and requires minimum human intervention. It is one of the only two facilities in Asia with UHT technology.

Presence across entire Value chain:

The company has several products with target all the customers across the entire pyramid with the majority of the products in the Mid and low segment customers and the company also has a higher profit margin compared to its peers due to its higher value-added products.

Acquisition of Danone facility

It acquired the Sonipat facility from Danone Food and Beverages India Pvt. Ltd., which commenced operations in August 2018, it currently has a Milk & Curd Processing Unit

Subsidiary

Bhagyalaxmi Dairy Farms is a wholly-owned subsidiary of PMFL in Pune, established in 2005 as an R&D center for studying and developing practices for cattle feeding, rearing, and livestock management. This was used to help improve milk yields on farms owned by its farmers. Today it is India’s most modern dairy farm with 2,300 Holstein Friesian cows, spread over 35 acres.

Distribution Network and Procurement

Its distribution network comprises 19 depots, 170+ SKU’s, more than 140 super stockists connected to 3,000+ distributors. It engages with its consumers through more than 3.5 Lakh touchpoints.

Village collection centers procure milk from over 2 lakh farmers in 29 districts. The company caters to institutional clients in the HORECA segment, multinational QSRs, and pharmaceutical sector. It has a significant presence in major metro cities and is expanding its reach. It is the largest private player in Mumbai in the liquid milk market.

Launches and Developments

During FY20, it launched new variants under the Go brand such as Go Cheese Pizza Blend, Go Cheese Four Cheese, etc.

It also launched Avvatar Rapid, a whey-fortified hydration drink – a category-first in the country.

It expanded its fresh products business in the Northern & Eastern regions of the country.

New Plans

Its future plan is to install processing units at Newly Acquired Sonipat Facility for pouch milk, cup curd, etc., and expand the existing yogurt facility.

It intends to have the Health & Nutrition business as 7% of its portfolio in the medium term and drive its profitability and growth for both Cheese & Whey businesses.

The company will introduce high potential Lactose products as there is a huge opportunity for import substitution.

Financial Performance of the company:

Source: Finology Ticker

Consolidated Revenue from Operations for FY21 reported a degrowth of 24% YoY to Rs. 18,418 million as compared to Rs. 24,379 million in FY20. Gross Profit for FY21 stood at Rs. 4,799 million as compared to Rs. 6,232 million in FY20. During the year, the prices of milk increased post easing of lockdown restrictions after the first phase and peaked in Q4FY21. PMFL’s revenue declined by 24.5% in FY2021 impacted by a slowdown in the hotels, restaurants, and catering (HORECA) segment due to lockdown across the country during the year, coupled with low revenue from liquid milk to institutional customers through modern trade channels amid the pandemic. PMFL’s profitability was impacted in FY2021 with an EBITDA margin of 6.8% versus 8.7% in FY2020 due to a significant decline in revenue, leading to low absorption of fixed overheads.

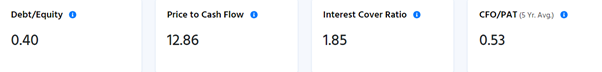

Source: Finology

The company is performing well on other metrics and has a limited debt on its balance sheet and has positive operating cash flows and the company is trading at a price of Multiples of 36x which is lower compared to its competitors like Hatsun and Doodla Diary and the company has been focusing on providing more value-added products which will enable the company to have a higher operating profit margin. Overall, one need not worry about the fundamentals of the company but should watch the overall growth achieved by the company.

Conclusion:

The maker of Gowardhan enjoys a greater reputation and has earned the trust of the customers and the company has taken various strategic initiatives that will enable the company to capture a higher market share. In value terms, the Indian dairy market is estimated to grow to ` 22,000 Billion in 2024 from ` 12,197 Billion in 2020. It is noteworthy that this steep rise in value is forecast against a moderate consumption growth in terms of volume. The real opportunity, hence, appears to be presenting itself in premium, high-end products which the company has understood well and is trying to capture the growing market.

share your thoughts

Only registered users can comment. Please register to the website.