Chambal Fertilizers & Chemicals Limited and Bharat Rasayan Limited Should Benefit from Rebound in Agro-Chemical Industry

Summary

- Gadepan-III plant of Chambal Fertilizers & Chemicals Limited led to market share increase in Urea, resulting in enhancing competitive strength on account of economies of scale.

- Focus of Chambal Fertilizers & Chemicals Limited is on strengthening reach in existing marketing territories and expansion in new geographies.

- Long-term investments and protection of supply lines should act as principal growth enablers of Bharat Rasayan Limited.

About Chambal Fertilizers & Chemicals Limited

India needs modernized agriculture sector to ensure food security to its population. To meet food grain requirements, agricultural productivity and growth should be sustained and improved. It is important to manage fertilizers for higher food production. Chambal Fertilizers & Chemicals Limited makes up for ~15% of total Urea produced in India. Since 2+ decades, the company has contributed to food security of India with responsibility. It caters to need of farmers in 10 states in northern, eastern, central and western regions of India. The company is categorized as a lead fertiliser supplier in State of Rajasthan, Madhya Pradesh, Punjab and Haryana. It has vast marketing network. It holds highest market share among Urea manufacturers present in private sector in India.

Growth Enablers of Chambal Fertilizers & Chemicals Limited:

- Higher Prices and Supply Constraints: During 1H22, sales volumes of Urea, DAP and MOP were lower year-over-year due to supply constraints. Rapid increase in prices impacted sales volumes of DAP and MOP. Increased fertilizers demand in Latin America and North

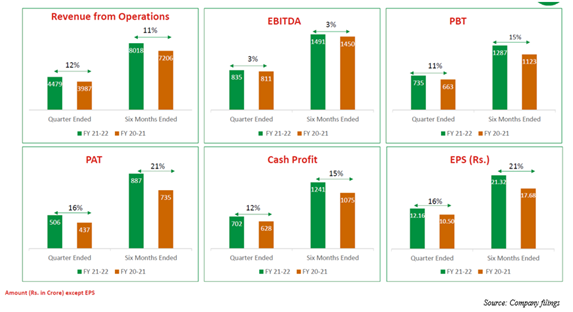

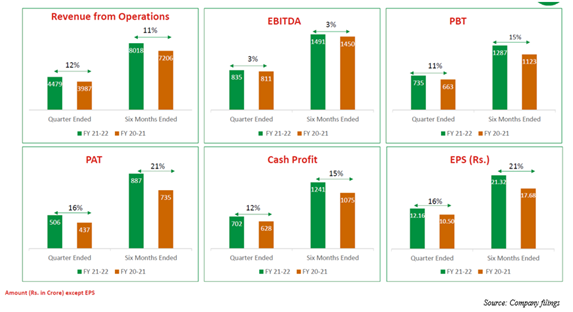

America pushed international prices of DAP, MOP and NPK fertilizers over 2Q22. DAP and NPK prices saw a push because of supply constraints from China. Spiraling prices significantly impacted phosphatic and complex fertilizer industry. There have been initiatives by Government of India which should support the company. Indian government announced additional subsidy of INR28,655 Cr. on phosphatic fertilisers and special package of INR5,716 Cr. for additional subsidy on DAP for Rabi season. On a standalone basis, the company saw revenue from operations of INR4,479 Cr in 2Q22 in comparison to INR3,987 Cr in 2Q21, exhibiting a growth of 12%. It saw 2% growth in its profit after tax in 2Q22 on year-over year basis to INR426 Cr.

- Highest Ever Revenue and Profit: FY21 kicked off with outbreak of Novel Coronavirus pandemic and India went into strict lockdown. The company was able to continue operations at normal levels. Production, dispatches, sales and market collections were not affected. When sectors were under stress, agriculture sector was not affected. Then, consecutive good monsoon in second year lent some support to the company in maintenance of growth momentum. It saw highest ever production and sales of Urea and highest sales volumes of DAP and MOP fertilisers. The company saw growth in sales of NPK fertilisers, sulphur, micro-nutrients and agrochemicals. Sales volumes of APS fertilizer were encouraging. During FY21, the company crossed an important milestone of 5 million MT of fertilisers sales. Increased sales volumes of Urea and increased volumes and healthy margins on marketed products helped the company achieve highest ever revenue and profit after tax during FY21. Since it is firmly established in existing marketing territory, Chambal Fertilizers & Chemicals Limited now looks forward to expand reach in new geographies in eastern, western and southern part of India. It continues to increase presence by opening marketing offices in these territories. Apart from DAP and MOP, focus now is to expand volumes of APS/ NPK fertilisers in new territories.

- Strong Industry Dynamics: The company has 3 manufacturing plants having annual production capacity of ~3.4 million MT of Urea. All 3 Urea manufacturing plants are located at Gadepan, District Kota, Rajasthan. This is largest single location Urea manufacturing facility in this country. Commercial production from first Urea plant of the company started in year 1994 and second Urea plant initiated commercial production in year 1999. Latest addition in series is third Urea plant that commenced commercial production recently in Jan 2019. Urea consumption is highest amongst all fertilisers which are being used in this country. Urea is considered as an important crop nutrient, playing vital role in ensuring food security in India. Manufacturers of Urea come from public, co-operative and private sector. Urea being manufactured in India is not sufficient to meet total demand. Hence, part of Urea demand is being addressed through imports. Price of Urea is controlled by Indian government. Gadepan-III plant of Chambal Fertilizers & Chemicals Limited is first plant which was set up under NIP-2012. This helped in reducing gap in demand and supply of Urea in India. Few more Urea plants are under implementation. Collectively, these plants should be able to make India largely self-dependent in Urea production. Government subsidy softened impact of increase in prices in DAP and NPK fertilizers. But, further increase in international prices continue to make situation challenging. Indian government made additional provision during FY21 for making payment of subsidy arrears.

- Significant Opportunities Should Lend Support: Gadepan-III plant lent some support to increase market share in Urea and has enhanced competitive strength because of more efficient operations due to economies of scale. After commissioning of Gadepan-III, it initiated focus on strengthening its reach in current marketing territories. This can be achieved through concerted brand building approach. It has renowned brand and healthy market share in DAP and MOP fertilisers and it is making inroads in NPK fertilisers space. Plans are there to replicate success in present marketing territory to new marketing territories and increase reach in existing marketing territories, providing opportunity to enhance sales volumes and market share. Few more plants should be able to become operational to increase indigenous supply of Urea during next 1-2 years. This should help reduce demand-supply gap in India. Given large size of phosphoric business, it developed reliable supply channels. The company expects to achieve better performance in crop protection and chemicals, micro-nutrients and NPK fertilizers. Now, some options are being evaluated to monetize excess ammonia available. The company has made some progress and was able to narrow down to suitable options.

Conclusion

Chambal Fertilizers & Chemicals Limited has a free float market cap of ~INR5,74,866.29 lakhs. At current market price, stock of the company trades at ~9.54x of FY22E EPS. This exhibits a deep discount to sectoral average of ~33.42x. Therefore, investors should go long.

Bharat Rasayan Limited

Bharat Rasayan Limited is in business of manufacturing pesticides. The company is a backward integration project to manufacture Technical Grade Pesticides and Intermediates which confirm to international standards. Initial public issue by the company in 1993 saw overwhelming response. Currently listed on NSE, this company became major stakeholder in Tata owned Siris Crop Sciences Ltd. and acquired it in due course.

Growth Enablers of Bharat Rasayan Limited:

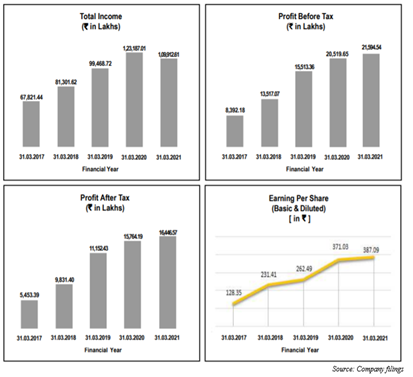

- Focus on Long-term Investments: Despite impact of external and internal factors, investments to scale were made in FY21 which should support the company in long-term. Investments were made for expanding manufacturing capacities, setting up new capacities for critical inputs and acquiring more product registrations. Net sales of INR269.13 Cr saw a fall of 15.49% year over year, with profit for period falling 23.9% year over year in 2Q22. ‘China plus one’ sourcing strategy should lend support to India’s crop protection business. The company should be a key beneficiary given its distribution network and market position. Indian agriculture should continue to see growth, with an increase in investments and private funding. Bharat Rasayan Limited continues to work with industry peers and Indian Government to seek policy support.

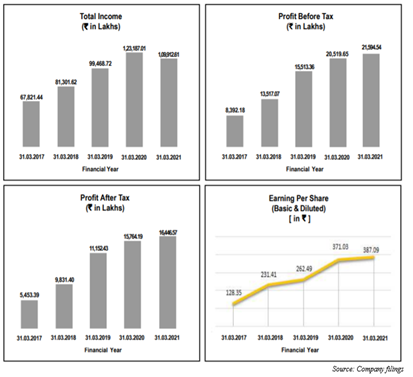

- Expectations of Steady Performance: In FY21, Bharat Rasayan Limited was able to achieve a turnover of INR1099.12 Cr., exhibiting a 10.78% decline over previous year turnover of INR1231.87 Cr. The company earned profit before tax of INR215.94 Cr. and profit after tax of INR164.46 Cr. The company should be able to achieve steady performance in upcoming years which should stem from strong portfolio, distribution network and brand equity. Focus of the company is now on protecting supply lines, serving demand, contributing to society and optimizing use of cost and cash. Despite near-term ambiguity, the company remains quite optimistic about medium to long-term growth of Agro chemical sector.

- Stable Outlook: Bharat Rasayan Limited plans to implement key initiatives across functions. This should support the company to enable to face market challenges and leverage emerging opportunities. Plans are there to execute initiatives focused on improving revenue growth and profitability. This should be helped by high growth segments like seeds and nutrients. The company's total expenses saw a decline of 13.69 % from INR989.11 Cr. in FY20 to INR853.74 Cr. in FY21. These expenses exclude depreciation and finance cost. Major expense items include cost of material consumed, purchase of stock-in-trade, power and electricity etc. Since progress has been made in optimizing these costs, the company should be able to achieve healthy growth rates.

Conclusion

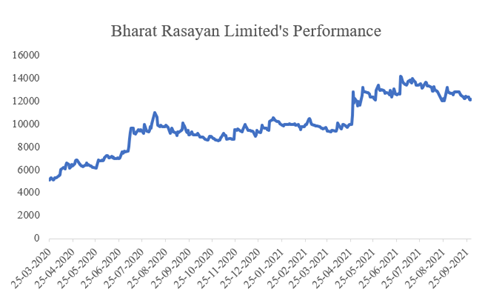

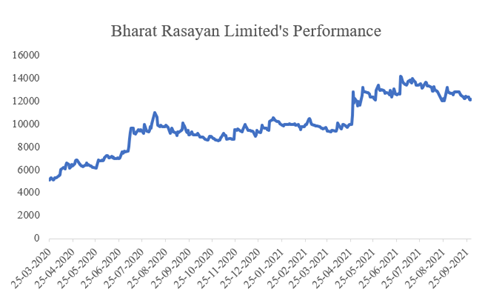

Bharat Rasayan Limited has a free float market cap of ~INR1,07,128.52 lakhs. Stock price of the company has seen a run up of ~138.9% between Mar 25, 2020- Sept 30, 2021. At current market price, stock of the company trades at ~25.24x FY22E EPS. This exhibits a deep discount to sectoral average of ~33.42x, which favors going long.

Exclusivity:

This article is exclusive to investoguru.

Stock Disclosures:

The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Author Disclosures:

This Article represents the Author's own personal views. The Author did not receive any compensation and do not have any business relationship with any of the companies mentioned in the Article.

share your thoughts

Only registered users can comment. Please register to the website.